Entertainment

JR's Paris Bridge Cave: Pont Neuf Transformed into Immersive Art Installation

French artist JR will transform Paris' historic Pont Neuf bridge into a monumental walk-through cave installation in June 2026, featuring sound by Daft Punk's Thomas Bangalter and augmented reality technology.

Sports

Conor Benn's Shock Split from Eddie Hearn: A Boxing Betrayal with Lasting Repercussions

Conor Benn's sudden departure from Eddie Hearn's Matchroom to join Dana White's Zuffa has rocked boxing, revealing deep tensions over loyalty, money, and betrayal in the sport.

Politics

Robert Aramayo's Double BAFTA Triumph and 'One Battle After Another' Dominates 2026 Ceremony

British actor Robert Aramayo stunned by winning Best Actor and the EE Rising Star award at the 2026 BAFTAs, while Leonardo DiCaprio's film 'One Battle After Another' led with six wins, including Best Picture.

Crime

NSW Braces for Potential Return of Islamic State-Linked Women and Children from Syria

New South Wales authorities are preparing for the possible repatriation of women and children with links to Islamic State from Syria, amid ongoing security and humanitarian concerns.

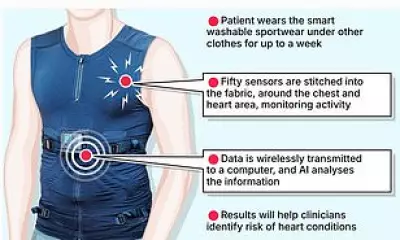

Health

Weather

NYC Mayor Declares Emergency and Travel Ban for Blizzard

New York City Mayor Zohran Mamdani has declared a local state of emergency and issued a travel ban as the city prepares for its first dangerous blizzard in over a decade, with up to 24 inches of snow forecast.

NYC Mayor Declares Emergency and Implements Travel Ban

New York City Mayor Zohran Mamdani has declared a local state of emergency and ordered a travel ban as the city prepares for its worst blizzard in over a decade, with schools closed and non-essential vehicles restricted.

Thailand Hit by 6.5 Magnitude Earthquake After Borneo Quake

A significant magnitude 6.5 earthquake has struck Thailand, as reported by the German Research Centre for Geosciences. This seismic event follows a magnitude 6.8 quake in Borneo, highlighting regional tectonic activity.

US Northeast Braces for Blizzard with Heavy Snow and High Winds

A severe winter storm is hitting the US Northeast, with blizzard warnings from Maryland to Massachusetts, over 6,000 flights cancelled, and residents urged to stay indoors.

East Coast Blizzard: 12,000 Flights Delayed, 18 Inches Snow Forecast

A severe nor'easter batters the East Coast, causing massive flight cancellations and delays while forecasters predict up to 18 inches of snow and dangerous blizzard conditions across multiple states.

Tech

Get Updates

Subscribe to our newsletter to receive the latest updates in your inbox!

We hate spammers and never send spam

Environment

UK Geography Quiz: Test Your Knowledge

Challenge yourself with 100 multiple-choice questions about the geography of the United Kingdom. Perfect for students, travelers, and geography enthusiasts.