Entertainment

BBC Apologises for Broadcasting Racial Slur During Bafta Film Awards

The BBC has issued an apology after failing to edit a racial slur from its Bafta Film Awards coverage. The offensive language was shouted by Tourette syndrome campaigner John Davidson during the ceremony.

Sports

Tottenham's Relegation Fears Mount After Arsenal Thrashing Under Tudor

Igor Tudor's Tottenham suffered a brutal 4-1 loss to Arsenal, sparking fears of relegation as they sit just four points above the drop zone with a winless streak.

Politics

BAFTAs 2026: Tourette's Guest's Racial Slur Sparks Controversy and Debate

The BAFTAs 2026 began with controversy as a guest with Tourette's syndrome used a racial slur during the ceremony, prompting responses from actors and the BBC.

Crime

Israeli Settlers Torch West Bank Mosque During Ramadan Start, Sparking Outrage

Israeli settlers vandalized and set fire to a mosque in the West Bank town of Tell near Nablus early Monday, spray-painting offensive phrases and causing significant damage as Muslims began observing Ramadan.

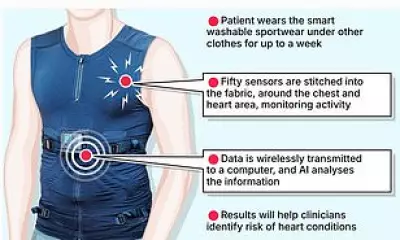

Health

Weather

NYC Mayor Declares Emergency and Travel Ban for Blizzard

New York City Mayor Zohran Mamdani has declared a local state of emergency and issued a travel ban as the city prepares for its first dangerous blizzard in over a decade, with up to 24 inches of snow forecast.

NYC Mayor Declares Emergency and Implements Travel Ban

New York City Mayor Zohran Mamdani has declared a local state of emergency and ordered a travel ban as the city prepares for its worst blizzard in over a decade, with schools closed and non-essential vehicles restricted.

Thailand Hit by 6.5 Magnitude Earthquake After Borneo Quake

A significant magnitude 6.5 earthquake has struck Thailand, as reported by the German Research Centre for Geosciences. This seismic event follows a magnitude 6.8 quake in Borneo, highlighting regional tectonic activity.

US Northeast Braces for Blizzard with Heavy Snow and High Winds

A severe winter storm is hitting the US Northeast, with blizzard warnings from Maryland to Massachusetts, over 6,000 flights cancelled, and residents urged to stay indoors.

East Coast Blizzard: 12,000 Flights Delayed, 18 Inches Snow Forecast

A severe nor'easter batters the East Coast, causing massive flight cancellations and delays while forecasters predict up to 18 inches of snow and dangerous blizzard conditions across multiple states.

Tech

Get Updates

Subscribe to our newsletter to receive the latest updates in your inbox!

We hate spammers and never send spam

Environment

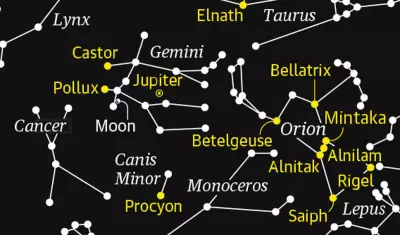

UK Geography Quiz: Test Your Knowledge

Challenge yourself with 100 multiple-choice questions about the geography of the United Kingdom. Perfect for students, travelers, and geography enthusiasts.