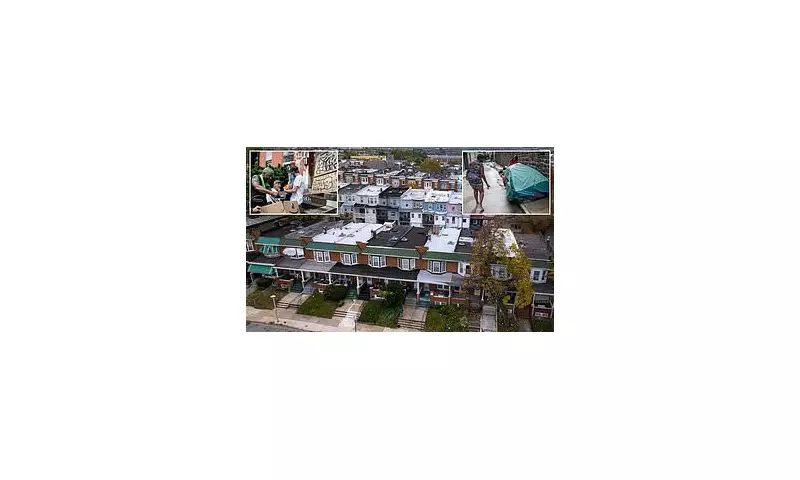

A once-vibrant American city is now scarred by rows of boarded-up and neglected homes, following a property investment scheme that targeted overseas buyers. An Argentinian businessman stands accused of misleading investors from his homeland and beyond with false promises of lucrative returns from Baltimore real estate.

The Broken Promises of a Transatlantic Scheme

Fernando Plastino convinced investors, primarily from Argentina, to purchase residential properties in Baltimore, Maryland. He offered a seemingly turnkey solution: his company would manage the acquisitions, handle tenant relations, collect rent, and pass the profits to the investors for a fee. According to reports from the Baltimore Banner, investors initially received payments but these soon stopped, leading them to realise they had been misled.

This case is the latest in a troubling pattern for the city, where foreign investors from Hong Kong, Israel, and Turkey have also encountered severe problems after dealing with companies promoting Baltimore property as a golden opportunity. The aftermath is visibly etched into the cityscape, with empty and dilapidated homes becoming a common sight.

Legal Battles and Derelict Properties

The scale of the alleged mismanagement has forced city officials to take action. Tammy Hawley, a spokesperson for the Baltimore Department of Housing & Community Development, confirmed the agency is "aware of Mr Plastino and his various shell corporations." Many properties linked to his company, FPBC LLC, are in such poor condition that former clients claim renting them out was nearly impossible.

Attorney Brett M. Dieck is representing several outraged foreign investors in legal action against Plastino. In one illustrative case, an investor was told a property on West Baltimore's Edmondson Avenue no longer had a tenant, so no rent was due. When the investor travelled to the US, an employee claimed they couldn't enter because it was occupied. The reality was starkly different: the home was empty, lacked water service, and repairs were incomplete, with estimated damages of $18,000.

Another entity, Real Estate Century Corp, alleges it paid $5 million to Plastino to buy and renovate buildings for apartments. Court papers claim Plastino repeatedly gave "personal promises" that work was almost complete, but "did not have the ability and/or skill required to deliver."

A Recurring Problem for Baltimore

Plastino’s legal team has argued he is wrongly accused of fraud, citing unclear agreements and delays caused by utility companies and city regulations. Despite many Argentine investors cutting ties, Plastino still owns dozens of properties through FPBC LLC.

Local property manager Yehuda Blasenstein told the Banner that such issues are regrettably common in Baltimore. He noted that outside investors frequently run into trouble when partnering with local operators, stating, "It's the same story over and over again, with little differences."

While some investors, like the one on Westwood Avenue, have poured in extra funds to renovate their properties, the scandal highlights the significant risks of long-distance real estate investment. It also underscores the ongoing challenge for Baltimore as it grapples with the physical and economic blight left by failed property schemes.