Money Saving Expert founder Martin Lewis has issued a critical warning to UK savers and investors about potential changes to ISA rules under a potential Labour government.

In his latest money newsletter, the consumer champion highlighted that Shadow Chancellor Rachel Reeves has not ruled out reviewing the generous tax breaks offered by Individual Savings Accounts (ISAs).

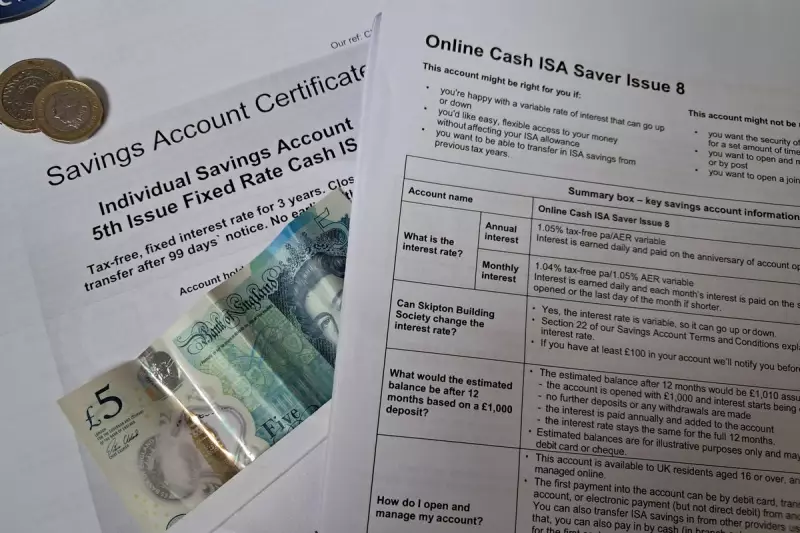

The ISA Deadline You Can't Afford to Miss

Lewis emphasised the importance of using your current year's ISA allowance before the April 5th deadline. "If you don't use your 2023/24 allowance by April 5, you lose it forever," he stressed, reminding savers that the current £20,000 annual limit cannot be carried forward.

What Labour's Tax Review Could Mean for Your Savings

While Labour has committed to not increasing the basic rates of income tax, National Insurance, or VAT, the party has been notably silent on ISA taxation. Lewis pointed out that Rachel Reeves has specifically stated she "wouldn't increase taxes on working people" but hasn't made the same commitment regarding savings and investments.

The Personal Savings Allowance Threat

Currently, basic-rate taxpayers can earn up to £1,000 in savings interest tax-free, while higher-rate taxpayers get a £500 allowance. Lewis warned that these allowances could be reduced or eliminated entirely under future government changes.

"If the personal savings allowance were cut or scrapped, the tax-free status of Cash ISAs would suddenly become much more valuable," Lewis explained.

Why Acting Now Could Save You Thousands

With interest rates at their highest levels in over a decade, more savers are finding themselves at risk of paying tax on their savings interest for the first time in years. Lewis outlined several compelling reasons to maximise your ISA contributions:

- Lifetime protection: Money saved in an ISA remains tax-free indefinitely

- Flexibility: You can split your £20,000 allowance between Cash ISAs and Stocks & Shares ISAs

- Future-proofing: Locking in current tax benefits protects against potential future changes

Expert Recommendations for Different Savers

Lewis provided tailored advice for different financial situations:

- For emergency funds: Consider premium bonds or high-interest current accounts alongside Cash ISAs

- For long-term investors: Stocks and Shares ISAs offer potential for higher returns over 5+ years

- For higher-rate taxpayers: Maximising ISA contributions provides crucial tax protection

The money expert concluded with his signature straightforward advice: "If you've spare cash you don't need for emergencies, using your ISA allowance is a no-brainer given the political uncertainty around future tax treatment of savings."