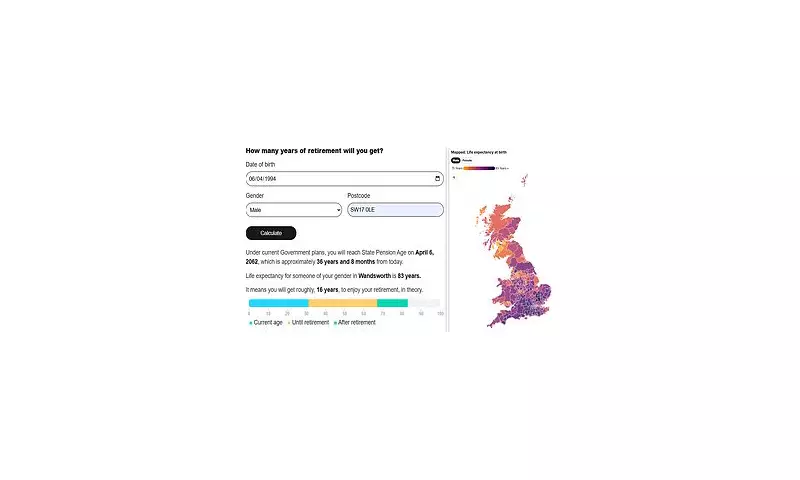

A stark postcode lottery is determining the retirement fortunes of millions across Britain, with pensioners in some areas receiving over £4,400 more per year than those in others, according to a shocking new analysis.

The research, which examined state pension data across all UK constituencies, reveals a deeply divided nation. Retirees in the affluent London constituency of Chelsea and Fulham enjoy the highest average annual payment of £11,177. This stands in brutal contrast to the £6,742 received by pensioners in Birmingham Ladywood—a devastating gap of £4,435.

The Winners and Losers of the Pension Divide

The pattern is clear and deeply concerning. Wealthier areas in London and the South East are consistently topping the charts. Following Chelsea and Fulham, the constituencies of Kensington and Cities of London & Westminster see average pensions of £10,889 and £10,688 respectively.

Meanwhile, the lowest pension payments are concentrated in major urban centres outside the capital. After Birmingham Ladywood, pensioners in Manchester Central (£6,826), Belfast West (£6,882), and Glasgow Central (£6,911) face the toughest financial struggles in their later years.

Beyond the North-South Divide

While a North-South split is evident, the inequality runs even deeper. The analysis shows that every single one of the top 50 constituencies for state pension payouts is located in the South of England, painting a picture of a profoundly uneven national landscape.

Conversely, the bottom 50 is dominated by areas in the North of England, Scotland, Wales, and Northern Ireland, suggesting a systemic issue that transcends simple geography and points to deeper economic and social disparities.

What's Driving the Great Pension Gap?

Experts point to several key factors creating this retirement inequality:

- Employment History: The ability to build a full 35-year National Insurance record varies significantly by region due to local job markets and economic opportunities.

- Salary Levels: Higher wages in areas like London allow for larger pension contributions throughout one's working life.

- Contract Types: The prevalence of zero-hours contracts and part-time work in some areas disrupts consistent pension contributions.

- Childcare Responsibilities: Historically, these have disproportionately affected women's ability to maintain continuous National Insurance contributions.

A Call for Change and Greater Awareness

This analysis serves as a crucial wake-up call for both policymakers and the public. The findings highlight an urgent need to address the structural factors preventing people across the UK from building adequate retirement savings.

For individuals, the message is clear: understanding your National Insurance record is paramount. The government's 'Check Your State Pension' service is an essential tool for everyone to see if they are on track and to identify any gaps in their contribution history that could be filled to secure a better financial future.

Without intervention, the retirement postcode lottery threatens to cement inequality for generations to come, leaving thousands of pensioners financially vulnerable simply because of their address.