In a bold move that defies mounting political pressure, America's top consumer financial watchdog is pressing ahead with an ambitious recruitment campaign despite looming threats of a government shutdown that could paralyse federal operations.

Agency Expansion Amid Political Turmoil

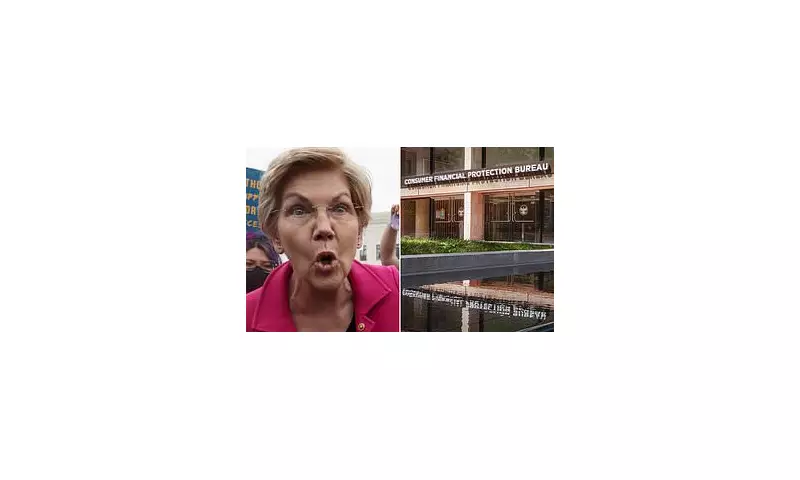

The Consumer Financial Protection Bureau (CFPB) is actively seeking to fill nearly 200 vacant positions across multiple departments, signalling confidence in its continued funding despite the political storm gathering in Washington. The aggressive hiring push comes as Republican lawmakers intensify their efforts to challenge the agency's controversial funding structure.

This expansion represents one of the most significant recruitment drives in the agency's history, with roles spanning from entry-level positions to senior regulatory experts. The timing couldn't be more contentious, with the agency's very existence potentially hanging in the balance.

Constitutional Showdown Looms

At the heart of the controversy lies a fundamental constitutional challenge that could reach the Supreme Court. Critics argue the CFPB's funding mechanism - drawing directly from the Federal Reserve rather than congressional appropriations - violates the Constitution's appropriations clause.

"This isn't just about hiring; it's about whether an entire federal agency can operate outside traditional congressional oversight," noted a constitutional law expert familiar with the case.

What This Means for UK Financial Services

While this is an American regulatory battle, the outcome could have significant ripple effects for UK-based financial institutions operating in US markets. The CFPB has increasingly focused on international financial transactions and cross-border consumer protection issues.

British banks and fintech companies with American operations are watching developments closely, as the agency's regulatory reach extends to foreign entities serving US consumers.

Key Positions Being Filled

- Enforcement Division: Multiple roles focusing on investigating financial institutions

- Consumer Response Specialists: Handling consumer complaints and inquiries

- Policy Analysts: Developing new financial protection regulations

- Technology Experts: Addressing emerging fintech and cybersecurity challenges

- Legal Counsel: Supporting ongoing litigation and constitutional challenges

The Political Stakes

The hiring surge represents a calculated gamble by CFPB leadership. By accelerating recruitment now, the agency may be attempting to cement its operational capacity before any potential funding crisis hits. However, this strategy carries significant risks if the courts ultimately rule against the agency's funding model.

Democratic supporters argue the CFPB's independence is crucial for protecting consumers from predatory financial practices, while Republican opponents see it as an unconstitutional power grab that bypasses congressional authority.

What Happens Next?

The coming months will prove critical for the agency's future. With multiple legal challenges working their way through the court system and political pressure mounting, the CFPB finds itself at a constitutional crossroads.

Meanwhile, the recruitment drive continues unabated, with agency officials expressing confidence that their funding will withstand both political and legal challenges. For now, the message from the CFPB appears clear: business as usual, regardless of the gathering storm clouds.