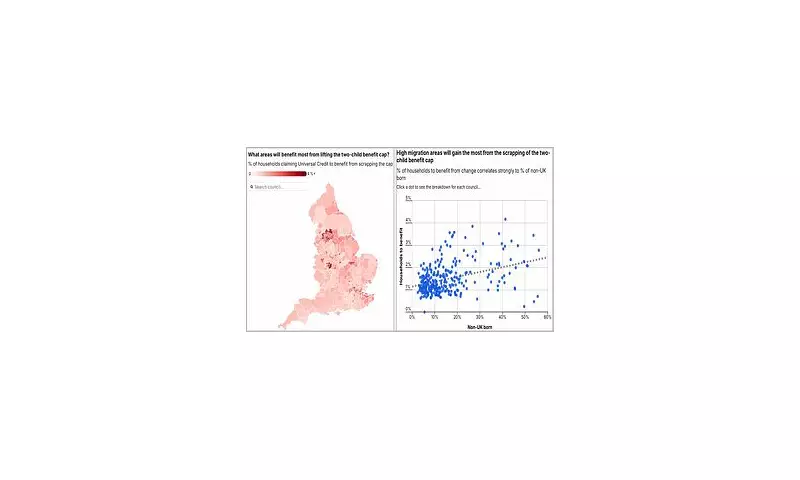

New analysis suggests families living in areas with high levels of immigration could be nearly twice as likely to benefit from the Labour government's decision to scrap the controversial two-child benefit cap.

According to a Daily Mail examination of official data, 2.2% of households in high-immigration council areas will gain from the policy change, compared to just 1.2% in areas with the lowest immigration levels.

Geographical Disparity in Policy Impact

The figures reveal striking regional variations. Local authorities with substantial foreign-born populations are set to see the highest uptake. In the East London borough of Barking and Dagenham, where over 41% of residents were born outside the UK, 4.2% of households (approximately 3,400 of 82,000) will benefit – the highest proportion in Britain.

Similarly, Luton and Brent, where 38% and 54% of residents respectively are foreign-born, will see 3.8% and 3.4% of households gain from the benefits boost.

However, the pattern isn't universal. Wealthy London boroughs with high foreign-born resident rates, including Kensington and Chelsea (54%), Westminster (56%), and the City of London (50%), are among the least likely to benefit from the change.

Political Controversy and Response

The analysis has sparked immediate political controversy. Robert Bates, research director at the Centre for Migration Control, described the policy as 'yet another attack on citizens who play by the rules, and a handout to high migration areas'.

Mr Bates added: 'There is no moral, fiscal or political justification for spending tens of billions of pounds every year in asylum costs, foreign aid, and welfare handouts to migrants.'

Opposition leader Kemi Badenoch branded Chancellor Rachel Reeves' Budget as one for 'Benefits Street' rather than hardworking British families. The £3 billion cost of scrapping the cap will be met by some of the £30 billion in tax increases announced in the budget.

Understanding the Two-Child Cap and Its Removal

Despite its name, the two-child cap has nothing to do with Child Benefit. It actually restricts Universal Credit and child tax credit payments to the first two children in most households, affecting third or subsequent children born after 6 April 2017.

The policy, introduced by George Osborne in 2015, was intended to ensure families on benefits faced 'the same financial choices' as working households. However, research suggests it has had minimal impact on family planning decisions while significantly affecting child poverty rates.

Currently, 470,000 families are affected by the policy, with about 59% having at least one adult in work. The removal of the cap is projected to lift approximately 450,000 children out of poverty by 2029/30, according to the Government's independent spending watchdog.

The financial impact for families will be substantial. A single parent with three children currently eligible for £20,978 in benefits could see this rise to £24,491 after the cap is lifted – exceeding the £21,807 take-home pay of someone working 40 hours weekly on minimum wage.

Labour MPs reportedly fear the disparity in who benefits could become a 'political flashpoint', particularly as the policy comes into effect from April 2026.

A Government spokesperson emphasised: 'Nine in ten children impacted by the two-child limit have a UK-born parent.' They added that with almost three-quarters of children in poverty living in working households, the government aims to give 550,000 of them a better start in life.