Home-shopping network QVC is reportedly in advanced talks to file for Chapter 11 bankruptcy as it explores options for voluntarily restructuring its substantial debt load. The company, which owns both the QVC and HSN brands, is grappling with a significant financial burden that includes $6.6 billion in outstanding obligations.

Financial Strain and Market Reaction

According to sources familiar with the matter, QVC's debt includes a credit facility set to mature in October, with approximately $2.9 billion already drawn from this line. The news of the potential bankruptcy filing sent shockwaves through the market, causing QVC's stock price to plummet by around two-thirds by the close of trading on Wednesday. This dramatic decline reflects investor concerns over the company's ability to manage its liabilities and sustain operations in a challenging retail environment.

Underlying Challenges Facing the Network

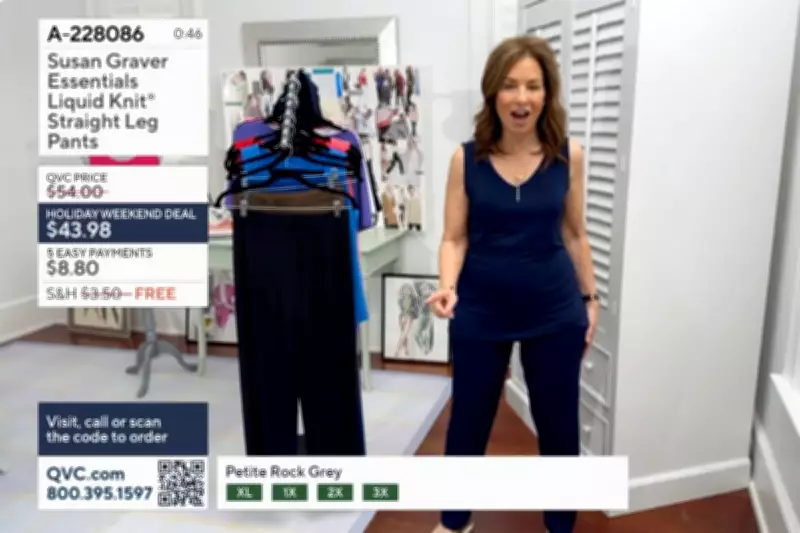

QVC is confronting a series of structural issues that have compounded its financial woes. The company has been experiencing a shrinking customer base and declining television viewership, trends that have eroded its traditional revenue streams. Additionally, QVC must address significant tax liabilities that further strain its cash flow. These challenges come despite efforts to modernize its business model, including a pivot towards live-streaming and social media shopping initiatives.

Recent Layoffs and Strategic Shifts

The potential bankruptcy filing follows hundreds of layoffs implemented by QVC in early 2025, a move aimed at reducing costs amid mounting pressures. The company has attempted to adapt to changing consumer habits by forging partnerships, such as one with TikTok, to tap into younger audiences and digital platforms. However, these strategies have yet to yield sufficient results to offset the broader decline in its core business, highlighting the difficulties in transitioning from legacy retail models to new digital paradigms.

As discussions continue, the future of QVC and HSN remains uncertain, with the possibility of bankruptcy putting the network's long-term viability in peril. Stakeholders are closely monitoring developments, as the outcome could signal a significant shift in the home-shopping industry landscape.