QVC's Financial Crisis Threatens Future of Home Shopping Pioneer

The future of the once-dominant home shopping network QVC hangs in the balance as the company reportedly contemplates a voluntary bankruptcy filing. According to sources cited by Bloomberg, QVC Group has been engaged in discussions to restructure its substantial debt, with Chapter 11 bankruptcy being a potential option. No definitive decision has been reached regarding such a filing, but the mere possibility has sent shockwaves through the retail sector.

Mounting Debt and Plummeting Stock Value

Financial pressures are mounting for QVC, which reported $6.6 billion in outstanding debt as of September. This includes a credit facility due to mature in October, with $2.9 billion already drawn from it. The Bloomberg report triggered a dramatic sell-off of the retailer's stock, which lost approximately two-thirds of its value by the close of trading on Wednesday. This sharp decline underscores investor anxiety over the network's precarious financial position.

Shifting Consumer Habits and Declining Viewership

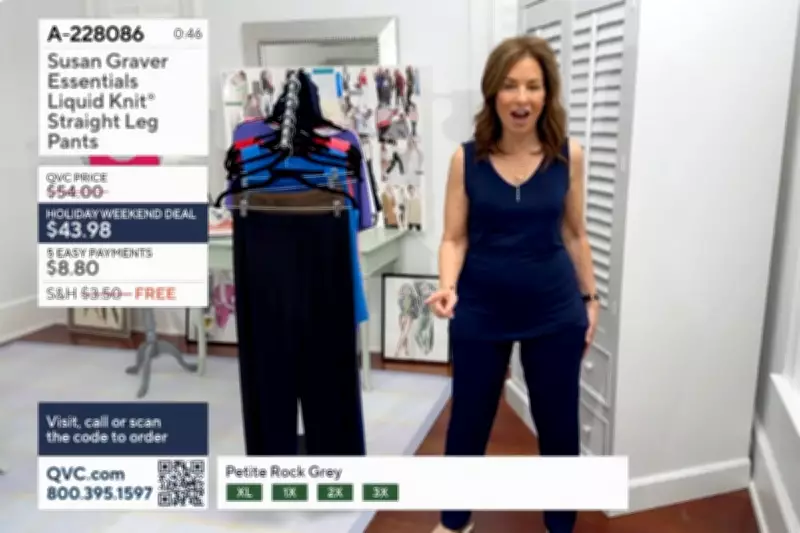

Founded in 1986, QVC revolutionized shopping by allowing consumers to purchase items like clothing, electronics, and beauty products from their living rooms via television. However, the rise of online shopping platforms has severely eroded its customer base. CEO David Rawlinson acknowledged during a November earnings call that decreasing TV viewership is exerting significant pressure on the business, stating, "Returning our company to growth continues to be difficult as challenges persist."

Strategic Pivots and Workforce Challenges

In response to these challenges, QVC has attempted to adapt by focusing on live-streaming and social-media shopping. After laying off hundreds of employees in early 2025, the company entered a partnership with TikTok in May of that year, aiming to create "the first 24/7 live shopping experience in the U.S." Plans were announced in August to hire about 250 employees by early 2026, though it remains unclear if those positions were filled. Additionally, the network, which owns both QVC and HSN channels, must address tax liabilities, according to insiders.

Uncertain Future Amid Ongoing Restructuring Talks

As QVC Group prepares to release its fourth-quarter 2025 earnings report later this month, the outcome of the debt restructuring talks will be closely watched. The potential bankruptcy filing highlights the broader struggles of traditional retail models in an increasingly digital marketplace. With its legacy as a cable television pioneer now at risk, QVC's ability to navigate this financial turmoil will determine whether it can survive in a landscape dominated by e-commerce giants.