Global financial markets experienced significant turbulence on Wednesday as geopolitical tensions surrounding Greenland triggered a flight to safe-haven assets, with gold reaching unprecedented levels while Asian equities mostly declined.

Market Reactions to Geopolitical Uncertainty

Asian share markets extended their losses during Wednesday's trading session as investor unease intensified over US President Donald Trump's tariff threats targeting Greenland. This development comes amidst already strained relations between Washington and its European allies, creating a perfect storm of market uncertainty.

Gold prices surged to a historic milestone, breaking through the $4,800 per ounce barrier for the first time ever with a substantial 1.7% gain. This remarkable rally demonstrates how capital is rapidly flowing into traditional safe-haven assets during periods of geopolitical instability and economic uncertainty.

Asian Market Performance

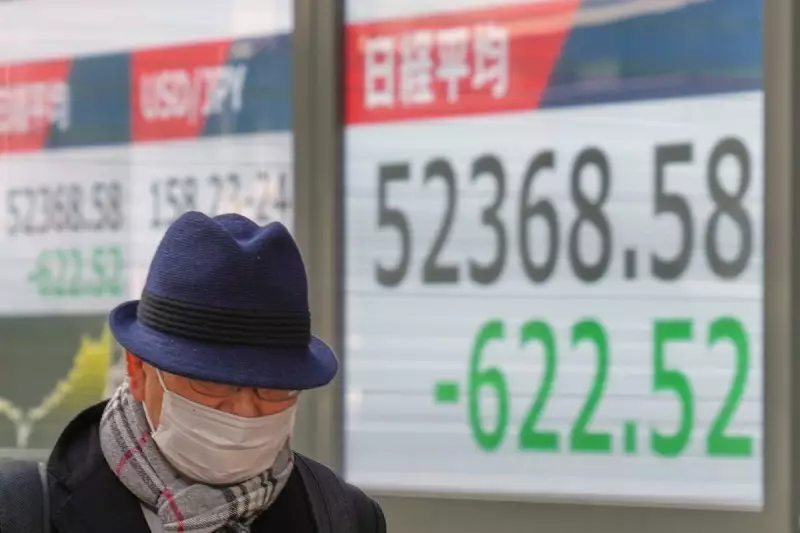

Across the Asia-Pacific region, market performance reflected the prevailing cautious sentiment. Tokyo's Nikkei 225 index declined 0.7% to settle at 52,603.44, with Japanese markets facing dual pressures from international tensions and domestic political developments.

Japanese Prime Minister Sanae Takaichi's decision to call a snap election for February 8 has added to market volatility, sending long-term government bond yields to record levels. The political move, aimed at consolidating power for the Liberal Democratic Party, raises concerns about potential tax cuts and increased spending that could exacerbate Japan's substantial government debt challenges.

Other regional markets showed similar patterns of decline. South Korea's Kospi shed 0.5% to reach 4,862.17, while Hong Kong's Hang Seng slipped 0.2% to 26,435.20. Australia's S&P/ASX 200 gave back 0.4% to settle at 8,781.70, and Taiwan's Taiex fell 0.9%.

The Shanghai Composite index provided a rare bright spot, edging 0.2% higher to 4,120.10, while India's Sensex managed a modest 0.1% gain.

US Market Movements and Corporate Impact

Following Tuesday's substantial losses on Wall Street, US futures showed tentative signs of recovery. The future for the S&P 500 advanced 0.3%, while the Dow Jones Industrial Average future rose 0.2%.

The previous trading session had witnessed significant declines across major US indices. The S&P 500 experienced its steepest drop since October, falling 2.1% to 6,796.86. The Dow Jones Industrial Average declined 1.8% to 48,488.59, and the Nasdaq composite fell 2.4% to 22,954.32.

Major corporations felt the impact of the market downturn, with technology giants particularly affected. Nvidia, one of the world's most valuable companies, saw its shares decline 4.4%, while Apple dropped 3.5%. The sell-off extended across multiple sectors, with retailers, banks, and industrial companies all experiencing substantial losses.

Geopolitical Context and Trade Tensions

The market volatility stems directly from President Trump's announcement of planned 10% tariffs on several European nations, including Denmark, Norway, Sweden, Germany, France, the United Kingdom, the Netherlands, and Finland, scheduled to begin in February. These proposed tariffs would be in addition to a 15% tariff specified in a pending trade agreement with the European Union that has yet to be ratified.

European leaders have responded strongly to these developments, with analysts suggesting potential countermeasures that could include delaying ratification of the trade agreement or implementing retaliatory tariffs. This escalation marks a significant deterioration in Washington's relations with its traditional Western allies.

President Trump has explicitly linked his position on Greenland to his disappointment at not receiving the Nobel Peace Prize last year, telling Norway's prime minister that he no longer feels "an obligation to think purely of Peace."

Central Bank Watch and Commodity Movements

Market participants are closely monitoring upcoming central bank meetings amid the current volatility. The Federal Reserve is scheduled to convene next week for its policy meeting, with Wall Street anticipating that the benchmark interest rate will remain unchanged.

Japan's central bank will conclude its first monetary policy meeting of the year on Friday, adding another layer of uncertainty to regional markets already grappling with political and economic challenges.

In commodity markets, oil prices retreated during early Wednesday trading. US benchmark crude oil declined 56 cents to $59.80 per barrel, while Brent crude, the international standard, shed 70 cents to $64.22 per barrel.

Currency markets showed modest movements, with the US dollar dropping slightly to 158.08 Japanese yen from 158.16 yen. The euro remained nearly unchanged at $1.1719.

Davos Anticipation and Presidential Travel

Market attention is now focused on President Trump's planned speech at the World Economic Forum in Davos, Switzerland, where he is expected to highlight his administration's accomplishments before an audience of world leaders, business elites, and billionaires.

The presidential trip experienced a minor disruption when Air Force One returned to Washington after crew members identified "a minor electrical issue" while en route to Davos. President Trump was scheduled to board another aircraft to resume his journey to the prestigious economic forum.

As global markets navigate this period of heightened uncertainty, investors continue to monitor geopolitical developments, central bank policies, and corporate performance indicators that will shape financial market trajectories in the coming weeks.