China has ramped up its financial pressure on the United States by imposing sanctions on Scott Bessent, a prominent American investor and former associate of George Soros. The move comes as part of Beijing's broader strategy to counter perceived US interference in its domestic affairs.

Who is Scott Bessent?

Scott Bessent, founder of Key Square Group, is a seasoned investor with deep ties to US financial circles. His firm manages billions in assets, and his career includes a stint at Soros Fund Management during the 1990s Asian financial crisis - an event that still colours China's perception of Western investors.

Why is China Targeting Bessent?

The sanctions appear to be retaliation against US measures targeting Chinese companies and officials. Analysts suggest Beijing selected Bessent specifically because of his financial influence and symbolic connection to Soros, whom Chinese authorities have long viewed with suspicion.

Broader Implications

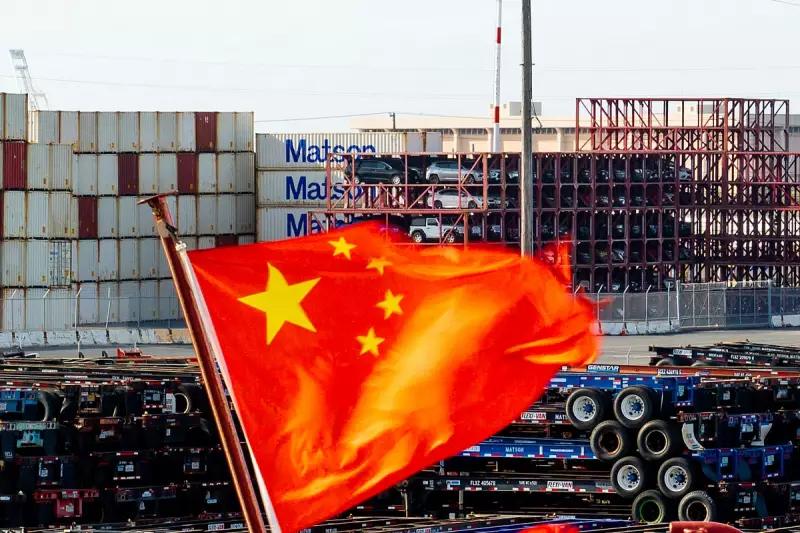

This development marks an escalation in the financial dimension of US-China tensions. Unlike previous sanctions that focused on politicians or military officials, targeting a private investor signals Beijing's willingness to extend economic pressure to the private sector.

The move comes as Janet Yellen, the US Treasury Secretary, prepares for crucial talks with Chinese counterparts. Observers warn these sanctions could further complicate already strained economic relations between the world's two largest economies.