London's premier stock index faced a turbulent trading session on Wednesday as two major retail-focused companies delivered sobering updates that sent shockwaves through the market.

Auto Trader's Steep Decline

Auto Trader, the UK's largest digital automotive marketplace, experienced its most dramatic single-day fall since 2022, with shares tumbling nearly 10%. The company reported a concerning slowdown in revenue growth, which dipped to 7% for the year ending March 31st, down from 9% in the previous quarter.

Despite posting an impressive 26% increase in pre-tax profits to £610 million, investors focused on the worrying trend of declining revenue momentum. The company acknowledged that ongoing economic pressures are making car purchases increasingly challenging for British consumers.

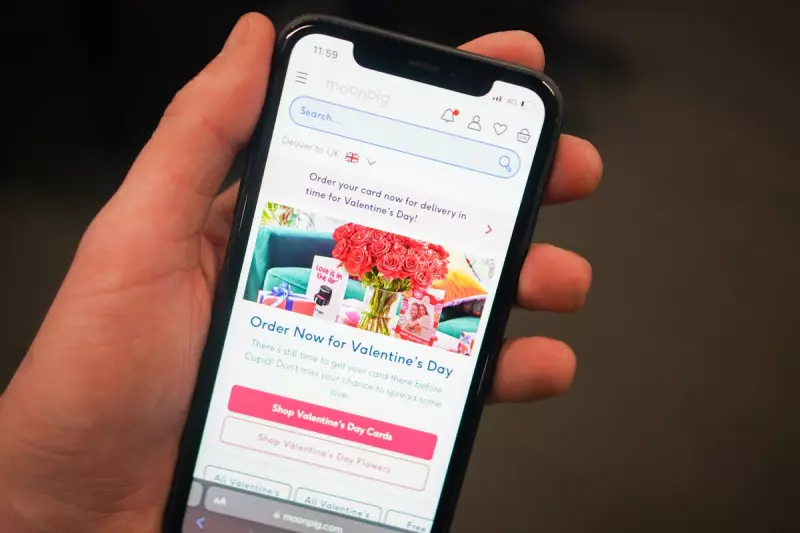

Moonpig's Valentine's Day Hangover

The situation proved even more severe for online greeting card retailer Moonpig, which saw its stock price collapse by a staggering 25%. The company issued a stark profit warning, revealing that sales growth had virtually stalled with just 1% revenue increase in the year to April 30th.

Moonpig's leadership pointed to "subdued consumer confidence" and weaker-than-expected performance following key gifting occasions like Valentine's Day and Mother's Day. The company now anticipates full-year earnings to fall significantly below market expectations.

Broader Market Impact

The dual setbacks created a drag on the entire FTSE 100, which struggled to maintain momentum despite broader positive trends in global markets. The disappointing performances from these consumer-facing businesses highlight the ongoing pressure on UK household budgets and discretionary spending.

Market analysts noted that these results serve as a barometer for consumer sentiment, suggesting that even established digital marketplaces aren't immune to the current economic headwinds affecting British shoppers.