Asian shares experienced a predominantly downward trend on Thursday, as a wait-and-see approach prevailed across regional markets in the wake of the Federal Reserve's decision to maintain its key interest rate. This move was widely anticipated, with Fed Chair Jerome Powell indicating that rates currently appear to be "in a good place."

Precious Metals and Currency Movements

In contrast to the equity declines, gold prices jumped by more than 4%, trading at $5,520 per ounce, while silver also saw a significant rise of 3.5%. The U.S. dollar weakened against the Japanese yen, and oil prices advanced, adding to the mixed financial landscape.

Regional Market Performance

In Tokyo, the Nikkei 225 slipped 0.2% to 53,274.71 during morning trading, despite gains from some technology firms reporting strong earnings. Advantest, a computer chip testing equipment maker, surged 6.7% after posting better-than-expected results, but most other tech shares fell.

Earnings season is intensifying, with major Japanese companies such as Toyota Motor Corp., Sony Corp., and Nintendo Co. scheduled to report next week. Elsewhere in Asia, South Korea's Kospi climbed 0.9% to 5,218.81, reaching a new record high, buoyed by a 2% gain for computer chip maker SK Hynix following a robust earnings report.

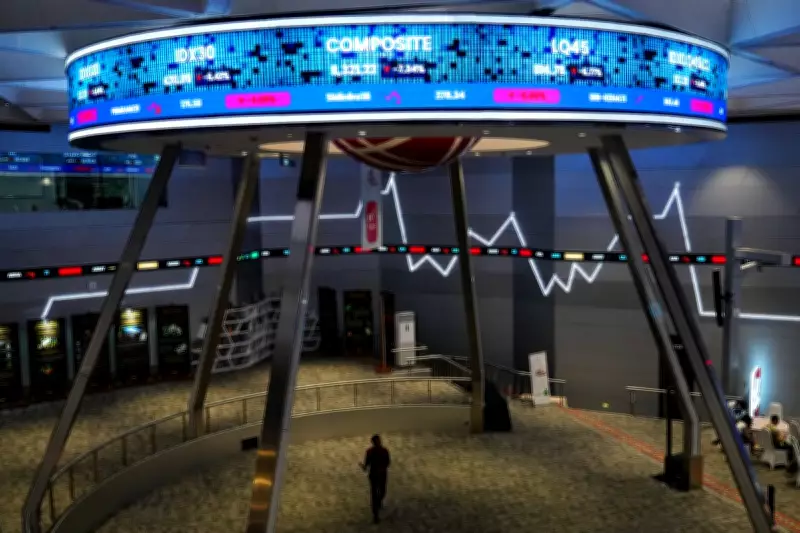

Hong Kong's Hang Seng added 0.3% to 27,905.24, while the Shanghai Composite index edged down 0.1% to 4,147.15. Australia's S&P/ASX 200 shed 0.6% to 8,883.30, and in Jakarta, the JSX plummeted 7.4% after MSCI, a U.S.-based provider of global indices, issued warnings about market risks in Indonesia.

U.S. Market Reaction and Corporate Highlights

The response to the Fed's rate decision in U.S. markets on Wednesday was relatively muted. The S&P 500 lost less than one point to 6,978.03, the Dow Jones Industrial Average rose 12 points to 49,015.60, and the Nasdaq composite gained 0.2% to 23,857.45.

Notable performers included Seagate Technology, which jumped 19.1% after reporting higher-than-expected profits, and Nvidia, which climbed 1.6% and served as a key driver for the S&P 500. Conversely, Apple slipped 0.7%, exerting the most downward pressure on the index.

Foreign Exchange and Economic Context

In foreign-exchange markets, the U.S. dollar stabilised following comments from Treasury Secretary Scott Bessent, who affirmed that the U.S. government is not intervening in currency markets and continues to support a "strong dollar." The dollar fell to 152.99 Japanese yen from 153.42 yen, while the euro rose slightly to $1.1983 from $1.1955.

Stephen Innes, managing partner at SPI Asset Management, noted in a commentary that a slightly firmer yen benefits U.S. manufacturing concerns, and symbolic Fed actions provide Tokyo with time and credibility. The yield on the 10-year Treasury remained steady at 4.24%.

The Fed had cut rates multiple times last year to bolster the job market, but inflation persists above its 2% target. Lower rates could potentially exacerbate inflation while stimulating the economy and weakening the U.S. dollar, which would aid exporters. Former President Trump has been actively advocating for reduced rates.

Energy Market Updates

In energy trading, benchmark U.S. crude increased by 76 cents to $63.97 a barrel, and Brent crude, the international standard, rose 68 cents to $68.05 a barrel.