The UK economy registered a stronger-than-anticipated expansion in November, with official data revealing growth of 0.3% for the month. This positive performance came despite significant uncertainty surrounding Chancellor Rachel Reeves's upcoming budget and was partly fuelled by the recovery of carmaker Jaguar Land Rover from a major cyber-attack.

November's Growth Surprise

According to figures released by the Office for National Statistics (ONS) on Thursday, economic output rose by 0.3% in November, a marked improvement from the 0.1% contraction recorded in October. This result comfortably exceeded the modest 0.1% growth forecast by most economists, providing a welcome boost for the Chancellor.

The data indicated that the services sector, the largest part of the economy, grew by 0.3%. The production sector saw a more robust increase of 1.1%, largely driven by a significant rebound in manufacturing. However, the construction industry experienced a setback, declining by 1.3% and raising concerns about the government's ambitions for a building boom.

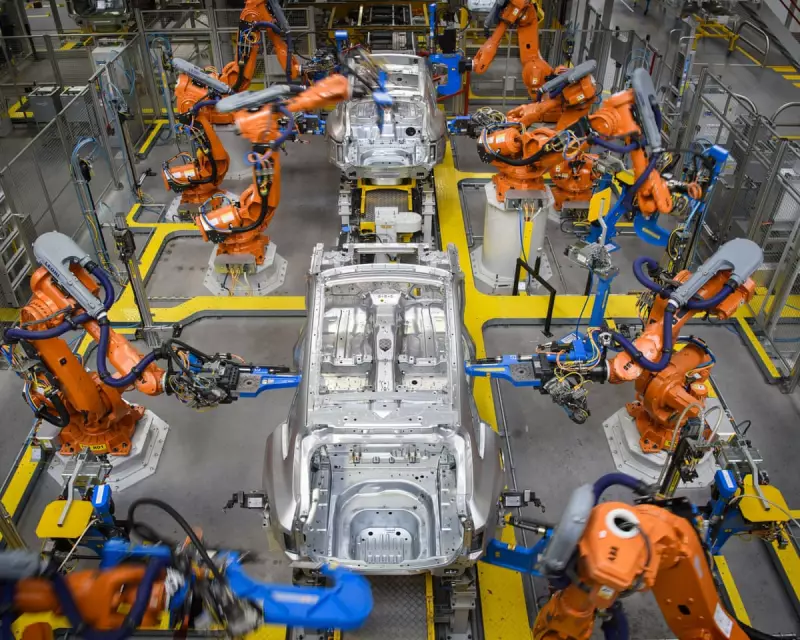

JLR Rebound and Sectoral Impact

A key driver behind November's improved figures was the resurgence of Jaguar Land Rover. Earlier in the year, a severe cyber-attack had severely disrupted the automotive giant's production, depressing overall economic output. The company's recovery manifested in a staggering 25.5% monthly increase in motor vehicle manufacture, directly contributing to the GDP growth.

Yael Selfin, Chief Economist at KPMG UK, suggested the economy had "found its footing" in November. "Despite the uncertainty ahead of the budget, economic activity accelerated," she stated, pointing to tentative signs of increased household spending. She anticipates the growth momentum to continue in the coming months.

Budget Context and Future Outlook

The growth data emerged against a backdrop of intense speculation in the run-up to Chancellor Reeves's second budget on 25 November, a period business groups blamed for deterring investment. Interestingly, the ONS noted that the largest contribution to service sector growth came from "professional, scientific and technical activities," with strong performances in accounting and tax consultancy—hinting that the pre-budget frenzy may have been profitable for some firms.

Economists at the National Institute of Economic and Social Research (NIESR) interpreted the figures as pointing to annual growth of 1.4% for 2025, which would be stronger than the previous year. Ben Caswell, a senior economist at NIESR, noted the Chancellor had significantly increased her fiscal headroom in the budget to bolster confidence, a move that appears to have eased policy uncertainty.

However, not all reactions were positive. Shadow Chancellor Mel Stride criticised the figures, stating that flatlining growth over the three months to November was "more evidence of Labour’s economic mismanagement." He argued the budget would leave working people worse off.

Looking ahead, Suren Thiru of the Institute of Chartered Accountants in England and Wales cautioned that this return to growth may not signal a sustained revival. He warned that softer consumer spending, a rising tax burden, and higher unemployment could lead to weaker growth in 2026. He also suggested the strong November data might make an interest rate cut in February less likely.

The government's focus now shifts to upcoming inflation and unemployment data, with Chancellor Reeves keen to see further interest rate cuts to aid the cost-of-living drive. She is also expected to announce additional support for the hospitality industry following a backlash over business rates changes.