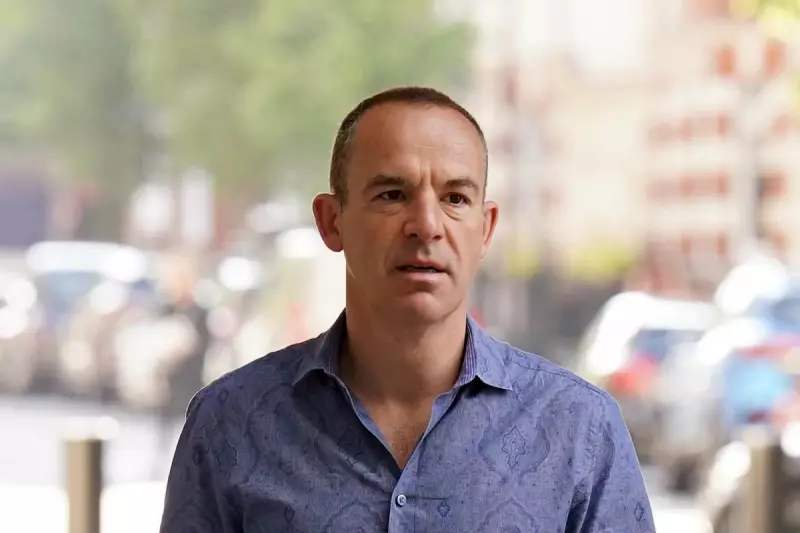

Financial expert Martin Lewis has secured a crucial update for UK pensioners during his post-Budget special, directly questioning Chancellor Rachel Reeves on the future of the state pension.

Key State Pension Increase Confirmed

The central announcement confirmed that the state pension will see a significant increase next year. From April 2026, payments are set to rise by 4.8 per cent.

This uplift will bring the full annual amount for the new state pension to £12,547.60. This figure places it just below the currently frozen personal allowance tax threshold of £12,570.

Tax Return Fears Addressed

During the discussion on 27 November 2025, the founder of MoneySavingExpert raised a critical concern for retirees. Martin Lewis pressed Chancellor Rachel Reeves on whether pensioners whose state pension exceeded the personal allowance would be forced to complete a self-assessment tax return.

In a clear and definitive response, the Chancellor provided reassurance. Reeves confirmed that individuals whose only source of income is the state pension will not be required to complete a tax return or pay any income tax during the current parliamentary term.

What This Means for Pensioners

This clarification from the Treasury offers significant peace of mind for millions of retirees across the country. It removes the immediate administrative burden and potential financial worry of dealing with the tax system for those relying solely on their state pension.

The confirmation means that despite the pension value creeping closer to the tax threshold, the government has committed to protecting this group from additional tax complexities for the foreseeable future.