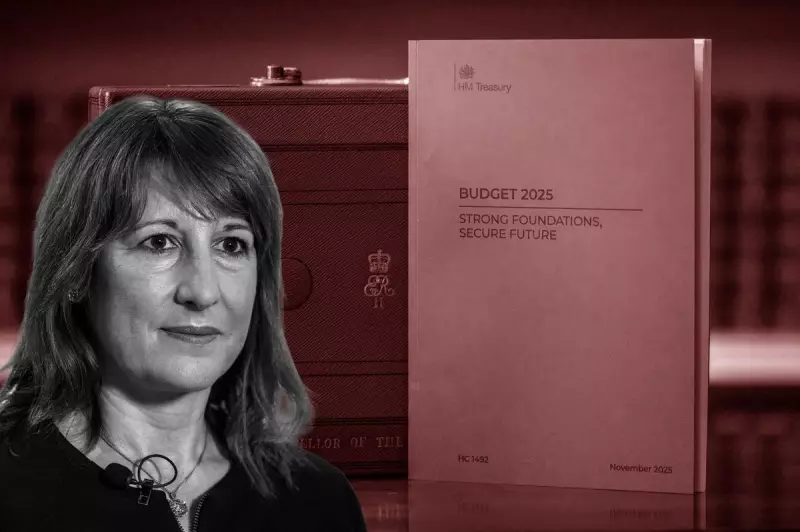

Chancellor Rachel Reeves's inaugural Budget, scheduled for Wednesday 26 November 2025, has become the most anticipated and contentious fiscal event in recent memory, even before its official announcement. A tumultuous run-up defined by significant policy leaks and abrupt government U-turns has severely rattled financial markets and revived profound doubts about the Labour government's economic competence.

A Prelude of Chaos and Market Jitters

Markets are known to despise uncertainty, and this Budget was intended by Chancellor Rachel Reeves to be a cornerstone for restoring stability. Instead, the opposite has occurred. The period leading to the announcement has been atrociously leaky and tumultuous, sowing fear among investors and the business community. Surprisingly, on the eve of the Budget, the pound—a key indicator of global confidence in the UK—edged higher against the dollar, even as reports indicated traders were betting against it.

The central questions loom large: just how severe will the fiscal pain be? Will the proposed measures, including potential tax rises, satisfy the bond markets that the UK relies upon to service its vast debt? And critically, how much damage has already been inflicted by the chaotic pre-Budget process itself?

The Dangerous Legacy of Budget Leaks

This is not the first time a Budget has been plagued by leaks. Historically, chancellors have frequently used the press to trial policies, a disingenuous but common practice despite official Treasury statements to the contrary. For instance, a Sky News analysis of Rishi Sunak's 2021 post-covid Budget found that 15 distinct elements had been leaked in advance.

While such leaks can sometimes steer a government away from a disastrous policy—as might have been the case with Liz Truss and Kwasi Kwarteng's 2022 mini-budget—the current situation is different. The problem with Reeves's Budget is not the leaks themselves, but the government's chaotic and inept handling of them.

One of the most damaging episodes was the reported plan to raise income tax, a direct violation of Labour's election manifesto. This idea, floated to help plug a public finance hole estimated between £20bn and £40bn, was swiftly retracted after a fierce public and political backlash, showcasing a government reacting rather than leading.

Economic Fallout and a Crisis of Confidence

The consequences of this amateurish approach are already being felt. The prolonged uncertainty, exacerbated by the Budget's late date, has forced businesses and investors into a defensive posture. Companies are postponing investment plans, focusing on cost-cutting and preserving cash margins rather than hiring. This defensive shift is reflected in the latest economic data, which shows a rising unemployment rate.

Transport Secretary Heidi Alexander's claims that the speculation has not been harmful are demonstrably false. The fear and uncertainty have spread like a virus, directly impacting economic activity. The business community's rapid disenchantment with Labour mirrors a historical cooling of relations, damaging the very economic growth that Reeves desperately needs to address the country's deep-seated problems.

While some of the leaks may be part of a traditional 'softening-up' process for bad news, the damage to the government's credibility is profound. Restoring faith among the movers and shakers in the City and across industry will be a long and difficult task. The question now is whether the current government possesses the skill and discipline to accomplish it.