Japanese stocks have surged to an unprecedented peak following a decisive electoral triumph by Prime Minister Sanae Takaichi's Liberal Democratic Party (LDP). The LDP clinched a commanding two-thirds majority in the lower house, marking a historic moment in Japan's parliamentary history since its establishment in 1947.

Landslide Victory and Market Reaction

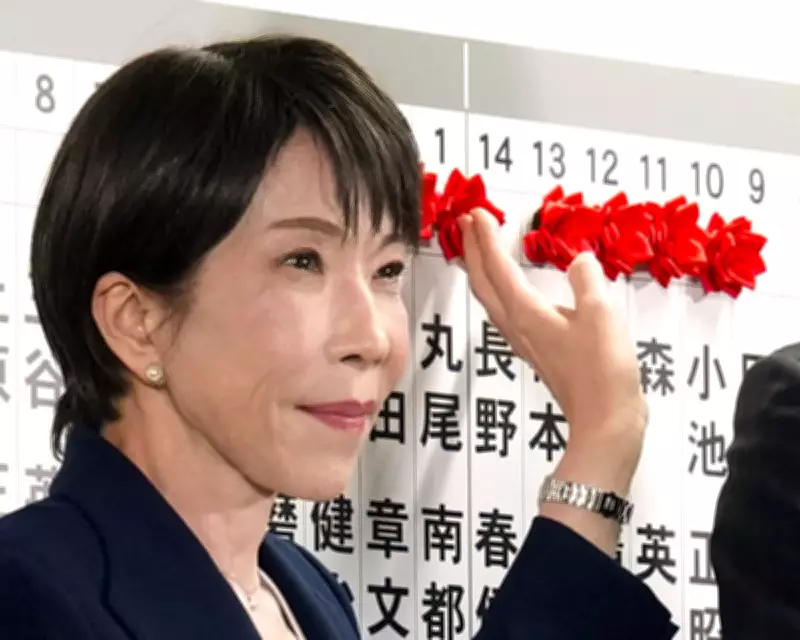

The Liberal Democratic Party secured 316 out of 465 seats in the lower house, the first instance of a single party achieving such a dominant position. Combined with its coalition partner, the Japan Innovation Party, which won 36 seats, the alliance now holds a supermajority of 352 seats. This overwhelming mandate significantly eases the legislative path for Takaichi, Japan's first female prime minister, who called a snap election in January.

In response to the election results, Japan's Nikkei share average skyrocketed, breaking through the 56,000 level at the start of trading and quickly surpassing 57,000 points. The index closed up 3.9% at 56,363 points, setting a new record high. This surge reflects investor optimism that Takaichi's strengthened position will facilitate swift action on promised fiscal measures.

Regional Market Impacts and Currency Movements

The positive sentiment extended across Asian markets, with South Korea's Kospi rising 4.4%, Hong Kong's Hang Seng gaining 1.8%, and Australia's S&P/ASX 200 increasing by 1.9%. On currency markets, the yen experienced volatility, initially weakening by 0.3% against the dollar to its lowest level in two weeks before strengthening as much as 0.7%. It was last trading 0.5% firmer at 156.43 yen against the dollar.

Government bonds fell as investors reacted to the election outcome, anticipating more aggressive fiscal policies. Takaichi has pledged to implement a substantial 21 trillion yen stimulus package and suspend Japan's 8% sales tax on food for two years. However, concerns persist over how Japan, which carries the highest debt burden in the developed world, will fund these initiatives.

Funding Challenges and Economic Uncertainty

The proposed tax suspension alone is estimated to cost approximately 5 trillion yen annually, equivalent to Japan's entire education budget. Takaichi has ruled out issuing new debt but has provided limited details on alternative funding sources, stating that specifics will be determined through cross-party discussions on social welfare and taxation.

Analysts note that while Takaichi's strong mandate could allow her to reconsider some aspects of the plan, she has publicly reaffirmed her commitment to the tax suspension. In televised interviews as election results were announced, she emphasized her intention to move quickly to fulfill the LDP's promises.

Currency Market Concerns and Government Response

Currency strategists, such as Sim Moh Siong of OCBC in Singapore, suggest that the yen may continue to face challenges in strengthening, with intervention risks potentially capping its upside. Japanese government officials have expressed concern over rapid movements in foreign exchange markets, with top spokesperson Minoru Kihara stating that authorities are monitoring the situation with high urgency.

This electoral victory not only consolidates conservative power in Japan but also sets the stage for significant economic policy shifts. As Takaichi navigates the complexities of funding her ambitious agenda, global markets will closely watch how these developments impact Japan's economy and its position in the Asia-Pacific region.