IRS Tax Refund Deadlines: Essential Dates and Processing Information

Understanding the Internal Revenue Service's tax deadlines and refund processing timelines provides crucial clarity for millions of American taxpayers awaiting their refund payments this season. While tax filing can be stressful, proper knowledge of key dates and procedures helps manage expectations regarding refund arrival times.

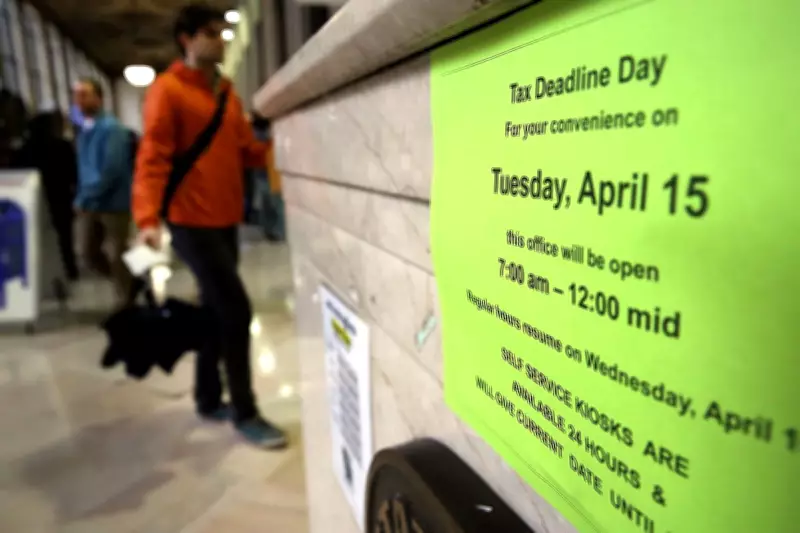

The Critical April 15 Deadline

Taxpayers must file their federal income tax returns by April 15, 2026. This date also serves as the deadline for paying any taxes owed to the IRS. Individuals can request a six-month filing extension using Form 4868, which pushes the submission deadline to October 15. However, this extension applies only to filing, not to payment obligations.

Important penalty information: The IRS imposes a 0.5 percent penalty on any unpaid tax balance after April 15. For taxpayers who file on time but establish a payment plan for their tax debt, the penalty reduces to 0.25 percent. These financial penalties underscore the importance of meeting the payment deadline regardless of filing extensions.

Refund Processing Timelines and Potential Delays

For electronically filed tax returns, the IRS typically issues refunds within 21 days after approving the return. Paper returns require significantly longer processing, with refunds taking up to 42 days according to official IRS guidelines.

This tax season faces two primary factors that could extend refund timelines:

- The IRS continues to experience staffing shortages and case backlogs that may prolong processing times, as detailed in recent Treasury Department reports.

- Amended returns require substantially longer processing. With approximately 590,000 amended returns currently backlogged, the IRS estimates processing times of eight to sixteen weeks or more for corrected filings.

These factors mean that while standard refunds might arrive within the typical 21-day window, taxpayers submitting amended returns should anticipate significantly longer wait times.

Tracking Your Refund Status

Taxpayers can monitor their refund progress through the IRS's Where's My Refund? online tool, updated daily between 4 a.m. and 5 a.m. Eastern Time. To access the platform, users must provide their Social Security Number or Individual Taxpayer Identification Number, filing status, and the exact refund amount expected.

The tool displays three possible status updates:

- Return Received: The IRS has your return but hasn't approved it yet.

- Return Approved: Your return has been approved, but the refund hasn't been issued.

- Refund Sent: Your refund is en route, typically appearing in bank accounts within five days or arriving by paper check within several weeks.

Update frequency varies by filing method: electronically filed current-year returns typically appear within 24 hours, past-year returns within three to four days, and paper returns may take up to four weeks to appear in the tracking system.

Proper understanding of these deadlines, processing times, and tracking methods helps taxpayers navigate the 2026 tax season with greater confidence and realistic expectations regarding their refund timelines.