Bitcoin has extended its recent recovery, pushing higher as the US dollar continues a prolonged decline on growing anticipation of an imminent interest rate cut from the Federal Reserve.

Market Movements and Key Data

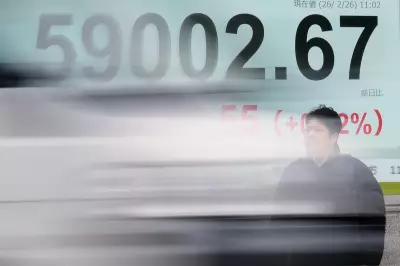

The world's leading cryptocurrency, Bitcoin, gained 0.28% to reach $91,878.30 on Wednesday, 3rd December 2025. This upward move comes despite the digital asset having crashed by almost a third since early October. The currency had suffered a significant slump at the start of December, following a difficult November where it fell more than $18,000, marking its largest dollar loss since May 2021.

The rally in risk assets like Bitcoin coincided with a broad rise in global shares and a fall in US Treasury yields. This shift was triggered by weak economic data that solidified market expectations for the Fed to ease monetary policy. Notably, data revealed that US private employment decreased by 32,000 jobs last month, starkly contrasting with economist forecasts for a 10,000-job growth.

Fed Speculation and Currency Impact

Market pricing now indicates an 89% probability of a 25 basis point interest rate cut at the Fed's upcoming meeting, according to the CME's FedWatch tool. "The consensus is that the Fed is going to lower the interest rate next week and I don't see any reason to question that at this point," stated Tom Plumb, chief executive and portfolio manager at Plumb Funds.

This environment has heavily pressured the US dollar. The dollar index, which measures the greenback against a basket of major currencies, fell 0.39% to 98.92, heading for its ninth straight session of declines. The euro hit a six-week high, last up 0.33% at $1.1661, while the dollar weakened 0.47% against the Japanese yen to 155.11.

Broader Financial Market Performance

Equity markets reflected the cautious optimism. On Wall Street, the Dow Jones Industrial Average rose 0.43%, while the S&P 500 edged up 0.05%. The Nasdaq Composite fell slightly by 0.12%. In Europe, the STOXX 600 index rose 0.13%.

In the commodities sphere, oil prices rose by around 1% as markets assessed faltering hopes for peace between Russia and Ukraine. Brent crude futures rose 1.18% to $63.19 a barrel. Spot gold, often seen as a safe haven, also gained, rising 0.22% to $4,216.57 an ounce.

Looking ahead, political developments add another layer of intrigue. President Donald Trump confirmed he would announce his pick to succeed Jerome Powell as Fed Chair early in 2026, with White House economic adviser Kevin Hassett emerging as the current frontrunner.