NS&I Modernisation Programme Slammed as 'Full-Spectrum Disaster' by MPs

A damning report from parliament's spending watchdog has declared the attempt to modernise the state-owned savings bank NS&I a 'full-spectrum disaster', with costs spiralling out of control and minimal transformation achieved to date.

Spiralling Costs and Unacceptable Risks

The Public Accounts Committee (PAC) revealed that the modernisation programme, originally budgeted at £1.3 billion, has now ballooned to an estimated £3 billion. Despite this massive expenditure, the committee found that 'little transformation' has been delivered, exposing taxpayers to what it described as 'unacceptable risk'.

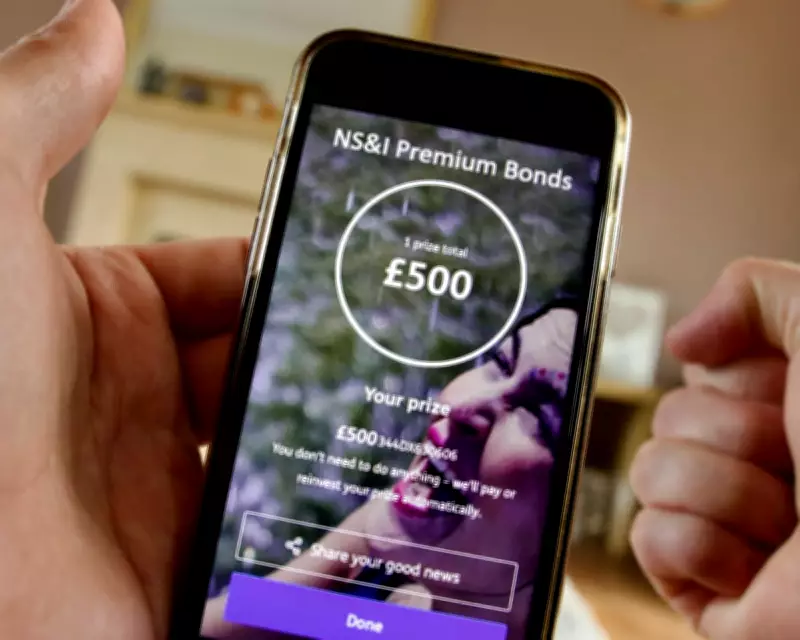

NS&I, which manages premium bonds and various savings accounts for around 25 million customers, launched the business transformation initiative – initially known as Project Rainbow – in 2020. The goal was to reduce operational costs and update its systems, including replacing the long-standing contract with French firm Atos, which had handled NS&I's banking services and IT infrastructure for 27 years.

Critical Failures in Planning and Execution

The PAC report highlighted several critical failures in the programme's management:

- Overambitious timelines: NS&I leaders underestimated the complexity of the project and set an unrealistic completion target of March 2024.

- Lack of detailed planning: Despite acknowledging the need for minute detail in managing the replacement of the core banking engine – a high-risk process due to sensitive customer data – no concrete plans were provided.

- Excessive reliance on consultants: The bank spent £43 million on external advice without having an agreed, integrated plan or the necessary in-house expertise.

Furthermore, NS&I now anticipates extending its contract with Atos, which faced financial difficulties in 2024, potentially until 2031, adding to the programme's delays and uncertainties.

Taxpayer Concerns and Government Response

Conservative MP Geoffrey Clifton-Brown, chair of the PAC, expressed deep concern over the project's mismanagement. 'It is deeply worrying to see a project in such an important organisation so off-track that neither this committee, or at times the Treasury itself, could gain an accurate sounding on costs and progress,' he stated.

He warned that without a realistic transformation plan, taxpayers risk 'throwing good money after bad' to salvage the programme. In a concerning move, the Treasury recently announced an additional £109 million in funding for the project, pending parliamentary approval, even though NS&I has been unable to provide a clear account of expenditures to date.

NS&I's Stance and Future Steps

NS&I, which holds over £240 billion in savings and provides cost-effective finance for government spending, responded to the report by welcoming its recommendations. The bank emphasised that its transformation programme is crucial for continuing to serve customers and support public finances efficiently.

'We are working on options to improve programme delivery and will provide an update on this in due course,' a spokesperson said, indicating ongoing efforts to address the criticisms and steer the project back on track.

As one of the UK's largest savings organisations, with a history dating back to 1861 and full government backing for deposits, the outcome of this modernisation effort remains critical for both savers and the broader public purse.