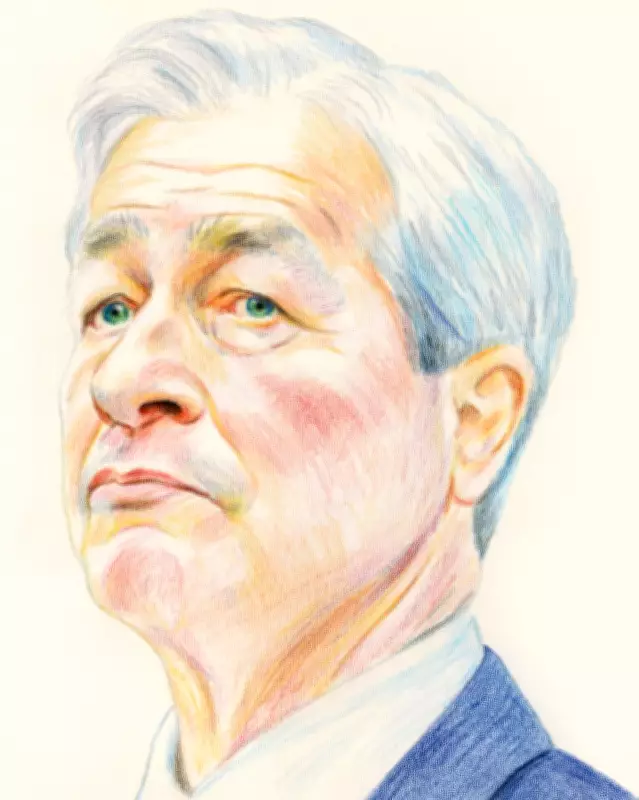

Jamie Dimon's Reputation Faces Unprecedented Challenges

Jamie Dimon, the long-serving chief executive of JP Morgan Chase, America's largest bank, finds his storied career under intense scrutiny. During a May 2023 deposition, Dimon testified under oath that he first learned of Jeffrey Epstein as a client in 2019, when news broke of Epstein's arrest and subsequent death. However, this claim is now being questioned amid the release of the US justice department's Epstein files, which document extensive interactions between Epstein and the bank.

Epstein's Deep Ties to JP Morgan Chase

Epstein maintained a relationship with JP Morgan Chase for 15 years, from 1998 to 2013, with Dimon serving as CEO for the final eight years of that period. The bank's private banking division treated Epstein as a high-value client, despite his criminal background. A belatedly filed JP Morgan report to the treasury department highlighted approximately 4,700 suspicious transactions linked to Epstein, totaling $1.1 billion, including payments to women from post-Soviet countries and wire transfers to Russian banks.

Contradicting Dimon's testimony, former JP Morgan executive Jes Staley asserted that he communicated with Dimon about Epstein years before 2019. Additionally, current senior executive Mary Erdoes, considered a potential successor to Dimon, was actively involved with the Epstein account and aware of his status as a high-risk sex offender. An email from 2010 further complicates matters, suggesting Dimon had an evening appointment with Epstein, though the bank denies this occurred.

Political and Legal Pressures Mount

Donald Trump has escalated tensions by demanding prosecutors investigate Epstein's connections to Dimon's bank and filing a $5 billion lawsuit against Dimon and JP Morgan Chase. Trump alleges political discrimination after the bank terminated his accounts following the January 6 Capitol riot. This legal action adds to Dimon's challenges, which include navigating America's polarized political landscape and anti-elite sentiment from both the right and left.

Democratic senator Ron Wyden emphasized the need for accountability, stating that Epstein was a known criminal and high-profile client, making it insufficient for bank leaders to claim ignorance. While Dimon has allies in Congress, such as Ro Khanna, who praised his empathy, Khanna remained noncommittal on believing Dimon's claims about Epstein, urging a follow-the-evidence approach.

Dimon's Career and Legacy in the Balance

Dimon, nearing 70 and in his 21st year as CEO, is in what he calls his "Last Act" before stepping down. His legacy, built during the 2008 financial crisis where he was hailed as a savior of the banking system, now risks tarnishment. The Epstein files have sparked doubts about his oversight, given his reputation for meticulous attention to detail and information gathering within his organization.

Despite these issues, Dimon continues to position JP Morgan Chase as a dominant force in global banking. The bank has grown significantly under his leadership, with assets exceeding $3 trillion and a workforce of over 300,000 employees. However, critics like MIT economist Simon Johnson argue that the bank's success is tied too closely to Dimon, raising concerns about its future post-his tenure.

Broader Implications for Banking and Politics

Dimon's situation highlights broader issues in the financial industry, including the persistence of "too big to fail" banks and moral hazard. Former Federal Reserve official Thomas Hoenig noted that this reality remains, with JP Morgan Chase epitomizing such institutions. Dimon has publicly contested this label, but experts maintain that government bailouts would likely occur if needed.

In response to the Epstein scandal, bank spokesman Joe Evangelista reiterated that Dimon never dealt with Epstein and that the files support this. He also defended Mary Erdoes and emphasized the board's independence. Meanwhile, Dimon's pragmatic approach has seen him adapt to political shifts, such as softening the bank's stance on diversity initiatives under Trump's influence, while maintaining support for an independent Federal Reserve.

As Dimon prepares for succession, his legacy will be judged not only by financial performance—with JP Morgan Chase's stock soaring under his watch—but also by how he addresses the Epstein fallout. His ability to "thread the needle" between personal beliefs and business needs, as analyst Mike Mayo described, is being tested like never before. Ultimately, this episode may redefine Dimon's image from Wall Street statesman to a figure entangled in one of banking's most notorious scandals.