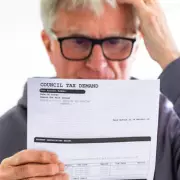

Check Your Council Tax Band to Save Thousands

Martin Lewis urges millions in England and Scotland to check their council tax band, as flawed 1991 valuations mean many are overpaying. Discover how to challenge your band and potentially claim back thousands.