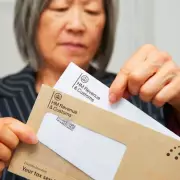

Retirees Face £1bn Pension Tax Shock from HMRC

HMRC is accused of 'highway robbery' as new data reveals over 10,000 pensioners a month are hit with emergency tax on withdrawals, with many waiting months for refunds. Experts demand urgent reform to the 'cruel' system.