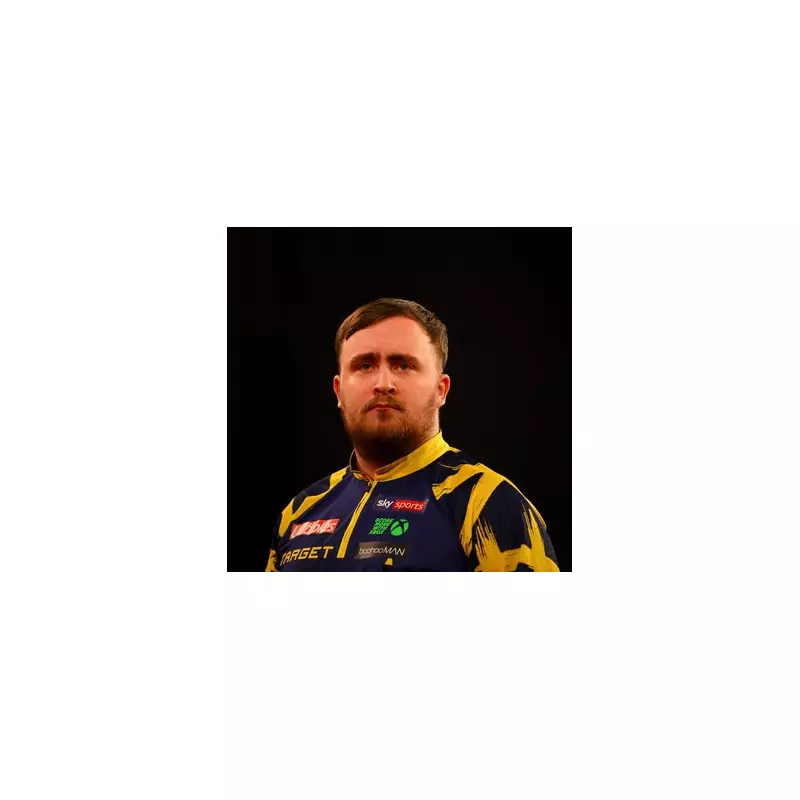

Darts prodigy Luke Littler continues his dominant streak on the oche, but each major victory comes with a significant financial deduction courtesy of the UK taxman.

Another Title, Another Tax Hit

The 18-year-old world number one secured his first Players Championship Finals title on Sunday, defeating Nathan Aspinall 11-8 in a hard-fought battle in Minehead. The win earned him a substantial £120,000 in prize money. However, celebrations are tempered by the reality that Littler must surrender an estimated £53,500 of that sum to HM Revenue and Customs (HMRC).

This financial pattern is familiar for the teenager, known as 'The Nuke'. His triumph is his sixth televised title, arriving just one week after he claimed the Grand Slam of Darts in Wolverhampton and ascended to the world No.1 ranking.

A Pattern of Substantial Deductions

Littler's incredible earnings over the past two years now total an impressive £1,970,000, but a large portion never makes it to his bank account. His landmark victory at the PDC World Darts Championship at Alexandra Palace earlier this year netted him a colossal £500,000.

According to UK tax laws, that single payday resulted in a massive £223,213 income tax bill, plus up to £12,010 in National Insurance contributions. This sliced over £230,000 from his take-home pay.

Similarly, his £150,000 prize for winning the Grand Slam of Darts saw nearly half of the amount claimed by the treasury. This recurring situation first came to public attention after his stunning run to the World Championship final in early 2024, where he pocketed £200,000 as runner-up.

HMRC's Cheeky Reminder

Following that initial success, the official HMRC social media account gave the young star a playful nudge about his new financial responsibilities. They congratulated him on his "fantastic run to the final" before adding, tongue-in-cheek: "We can confirm the existence of income tax."

Despite the substantial deductions, Littler's career trajectory remains meteoric. With the 2026 PDC World Darts Championship set to begin in December, all eyes will be on the teenager to see if he can clinch another life-changing payday—and face the corresponding tax implications once more.