Civil Service Pension Delays Force Retirees into Financial Hardship

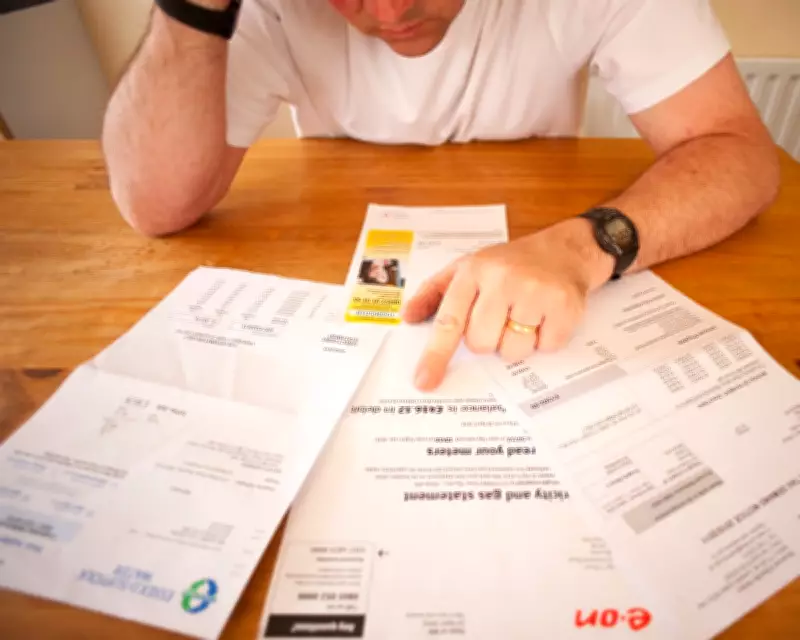

Newly retired civil servants across the UK are reporting severe financial distress due to significant delays in receiving their pension payments. Many have been left without an income for months, struggling to cover essential bills such as food, heating, and housing costs.

Government Acknowledges Crisis with Emergency Loan Scheme

The government has recognised the severity of the situation, describing the delays as "completely and utterly unacceptable". In response, interest-free hardship loans of up to £10,000 are being offered to the worst-affected retirees, with a standard amount of £5,000. Some individuals may also be eligible for compensation.

Nick Thomas-Symonds, a Cabinet Office minister, addressed a committee of MPs, confirming that many who retired since 1 December last year have not received their first pension payment. The Civil Service Pension Scheme is currently grappling with a backlog of nearly 90,000 cases, including claims and valuations, which could take months to resolve.

Personal Stories of Struggle and Desperation

Retirees have shared harrowing accounts of their financial woes. One former civil servant, who retired from the Department for Work and Pensions in August, exhausted her savings and was forced to apply for universal credit, leading to stress and antidepressant use. Another retiree, who submitted her claim in January 2025, has yet to receive any payment, relying on her children to buy food and unable to afford heating.

A 69-year-old retiree fears home repossession if his pension lump sum is not paid before his mortgage term ends in April, with his lender refusing an extension due to his age. He reported spending hours on hold with the pension administrator without success.

Administrative Handover and Systemic Failures

The Civil Service Pension Scheme, overseen by the Cabinet Office, was administered by MyCSP until December, when the contract transitioned to Capita. This change has been marred by issues, including members being unable to log into accounts, unanswered emails, and long phone waits. Capita has blamed MyCSP for inheriting a larger backlog than expected, while MyCSP asserts that all work was disclosed and agreed upon beforehand.

Capita, previously criticised for its handling of Teachers' Pensions, has increased staffing to address the backlog. However, problems persist, such as incorrect tax codes leading to unexpected tax bills for some members.

Impact and Response from Authorities

Catherine Little, the chief operating officer for the civil service, noted that about 8,500 people have experienced issues with pension payments since 1 December, though the exact number facing financial hardship is unclear. The Civil Service Pensioners' Alliance has been "deluged" with complaints since Capita took over.

The Cabinet Office has stated that strong contractual measures are in place to ensure Capita improves service delivery. A parliamentary report last October had already questioned Capita's readiness for the takeover, suggesting the government consider bringing administration in-house.

This ongoing crisis highlights broader concerns about pension scheme management and the welfare of public sector retirees, with calls for urgent resolution to prevent further financial suffering.