The government is set to unveil controversial plans that could allow water companies to escape financial penalties for polluting the environment. The proposed measures, detailed in a new white paper, have been condemned by campaigners as a "desperate" move that lets firms "off the hook".

A 'Turnaround Regime' to Prevent Collapse

Environment Secretary Emma Reynolds has described the upcoming reforms as "once-in-a-generation" changes designed to bring "tough oversight, real accountability and no more excuses" to the sector. Central to the plans is the creation of a new turnaround regime for companies deemed to be failing, either financially or in their performance on sewage pollution and water supply.

The government argues this regime will force such companies to fix their problems more swiftly and "give stability to investors". The Guardian understands the white paper, to be published on Tuesday, will grant the water regulator discretionary powers to "manage" fines to prevent a company's collapse. This could involve deferring penalties or waiving certain payments entirely.

A source at the Department for Environment, Food and Rural Affairs (Defra) stated the "aim is for every water company to eventually pay their fines". However, the move comes after creditors for the beleaguered Thames Water asked for the company to be let off future fines as it struggles to avoid financial ruin. In May 2025, Thames Water was hit with a record fine exceeding £120 million for environmental breaches related to sewage spills.

Campaigners and Industry React

The prospect of softened fines has sparked fierce criticism from environmental groups. Richard Benwell, CEO of Wildlife and Countryside Link, argued forcefully that polluters must pay. "If a company is fined because it’s done something wrong, it should either make restitution or the polluter should pay," he said.

He characterised the proposal as "a desperate play to be off the hook at the last minute", warning companies to consider the consequences of unlawful actions. "If a business hasn’t managed itself well enough to deal with the consequences of its shortcomings then it needs to deal with those consequences," Benwell added.

Conversely, industry sources indicated a turnaround regime would be welcomed, albeit with the recognition that companies would face restrictions on payouts to executives and shareholders if fines were reduced or deferred.

Broader Reforms and Infrastructure 'MOT'

The white paper forms part of the government's response to a wide-ranging review of the water sector by former Bank of England official Jon Cunliffe, which contained 88 recommendations. Other key changes outlined include:

- A new 'MOT for water companies' to force disclosure of infrastructure health.

- Dedicated supervisory teams for each water firm.

- "No notice" inspection powers for the regulator.

- A new chief engineer role within the regulator to oversee hands-on infrastructure checks.

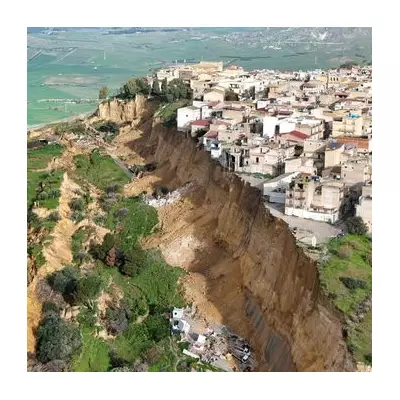

The government claims the 'MOT' would prevent crises like the recent water outages that affected tens of thousands of people in Kent and Sussex, incidents blamed on antiquated pipes and poorly maintained treatment centres. The UK's water network relies heavily on Victorian-era pipes, and no major reservoir has been built in over three decades.

Notably, the reforms will not alter the privatised ownership structure of water companies in England and Wales, the only fully privatised system in the world. The government had barred Cunliffe from even considering nationalisation in his report.

Prominent campaigner and former Undertones singer Feargal Sharkey dismissed the plans as "just a rearrangement of the deckchairs". He accused the government of being "terrified of dealing with privatisation" and sacrificing water quality "on the altar of shareholders and private equity".

The overhaul is due to be enacted through a Water Reform Bill. The government is also proceeding with plans to abolish Ofwat and merge its powers with other watchdogs into a new "super-regulator", though it is unclear if this body will be ready for the next critical price review in 2029.