How Your Money Can Support Green Issues Through Sustainable Investing

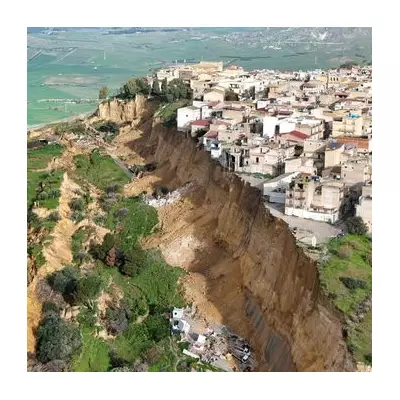

Amid a persistent climate crisis and what appears to be a rollback of environmental policies by some world leaders and corporations, there is a powerful silver lining: your personal finances and investments can actively support businesses that are forging a path toward a more sustainable and equitable future. More individuals than ever are seeking to invest with a conscience, aligning their financial goals with their values.

The Growing Demand for Values-Based Investing

A significant shift is underway in the investment landscape. The 2025 "Sustainable Signals" report by Morgan Stanley revealed that 77% of individual investors globally now desire to achieve positive social or environmental impacts alongside competitive financial returns. Despite this clear intention, widespread confusion about how to implement such strategies prevents many from taking the crucial first step.

This sentiment is echoed in the UK. Sustainable bank Triodos found that 81% of Britons express fear about the future. Yet, nearly half (49%) of all adults—and a striking 67% of those aged 18-34—state they want their money to "do good" but lack the knowledge of where to begin. If you identify with this position, consider this your comprehensive starting guide to aligning your finances with a greener and fairer world.

What Exactly Is Sustainable Investing?

First, it's essential to define what sustainable investing means to you personally. Your approach might involve avoiding industries you consider destructive, such as fossil fuels, tobacco, or weapons manufacturing. Alternatively, you might prefer a strategy of stakeholder engagement, where your investments are used to influence company behaviour from within. For instance, a fund might hold shares in major energy companies like Shell or BP, but use shareholder voting rights to push them toward financing more renewable energy projects.

Most sustainable funds focus on companies with strong performance on environmental, social, and governance (ESG) criteria. Research firms like Morningstar rate thousands of funds based on their ESG integration. Some strategies go further, engaging solely in impact investing, which targets companies making a measurable, positive difference for the planet and society.

Begin by identifying the causes that matter most to you—whether it's reducing carbon emissions, protecting biodiversity, alleviating poverty, or supporting fair trade. This clarity will guide where you allocate your investment capital.

Pathways to Sustainable Investment: ISAs, Pensions, and Banking

Stocks and Shares ISAs offer a tax-efficient wrapper, allowing you to invest up to £20,000 annually without tax on profits. Instead of selecting individual stocks, a less risky approach is to choose from curated sustainable funds. Platforms like EQ Investors, Triodos, and Liontrust offer highly-regarded impact funds, with some holding the "Good Egg" mark from ethical rating site Good With Money, signifying proven tangible impact.

Vigilance against greenwashing—where providers exaggerate sustainability claims—is crucial. The Financial Conduct Authority (FCA) is introducing a labelling system to clarify different investment approaches. Regardless of labels, conduct your own research: examine fund factsheets to see their holdings, objectives, and governance. Some platforms, like interactive investor, offer helpful tools such as their "ACE 40" list of top sustainable funds and ETFs.

Innovative Finance ISAs enable direct investment in pioneering companies and projects with clear social or environmental missions, counting toward your £20,000 ISA allowance. Platforms like Ethex offer bonds in ethical finance firms, while Energise Africa facilitates investments in clean energy projects in sub-Saharan Africa. These are typically higher-risk investments, so they should only form part of a diversified portfolio.

Greening your pension is remarkably powerful. According to campaign group Make My Money Matter, it can be 21 times more effective at reducing your carbon footprint than adopting a vegetarian diet, giving up flying, and switching energy providers combined. Their research indicates UK pension schemes invest £88 billion in fossil fuels—around £3,000 per holder. For every £10 in the average pension, £2 is linked to deforestation. To redirect your retirement savings, consider providers like PensionBee's Climate Plan, which avoids fossil fuel ties and invests in the low-carbon transition, or options like the NEST ethical fund and Penfold Sustainable Plan.

Performance and Additional Green Finance Options

A common concern is whether sustainable investing means sacrificing returns. Evidence suggests it can be a sound financial strategy. The premise is that companies focused on environmental stewardship, fair labour practices, and strong governance are better positioned for long-term success than those fixated solely on short-term profits. The 2025 Good Investment Review showed that actively-managed sustainable funds have performed comparably to traditional funds over the past five years, even in challenging markets. Companies causing harm increasingly face consumer backlash, stricter regulations, and financial penalties.

Beyond investing, consider where you bank. A 2023 "Banking on Climate Chaos" report found the UK's 'Big Five' banks provided over $55 billion in finance to fossil fuel companies. Ethical banks and building societies, by contrast, avoid harmful industries, treat stakeholders fairly, and pay their taxes. Triodos Bank is often cited as a gold standard, investing solely for positive impact. Member-owned building societies like Nationwide, Cumberland, and Coventry (which acquired Co-operative Bank) are also seen as strong ethical choices.

In summary, there are numerous avenues—from ISAs and pensions to everyday banking—to ensure your money supports sustainability. The key is to find the approach that aligns with your personal ideals and financial objectives, remembering that all investments carry risk, including the potential to get back less than you invest, and past performance does not guarantee future results.