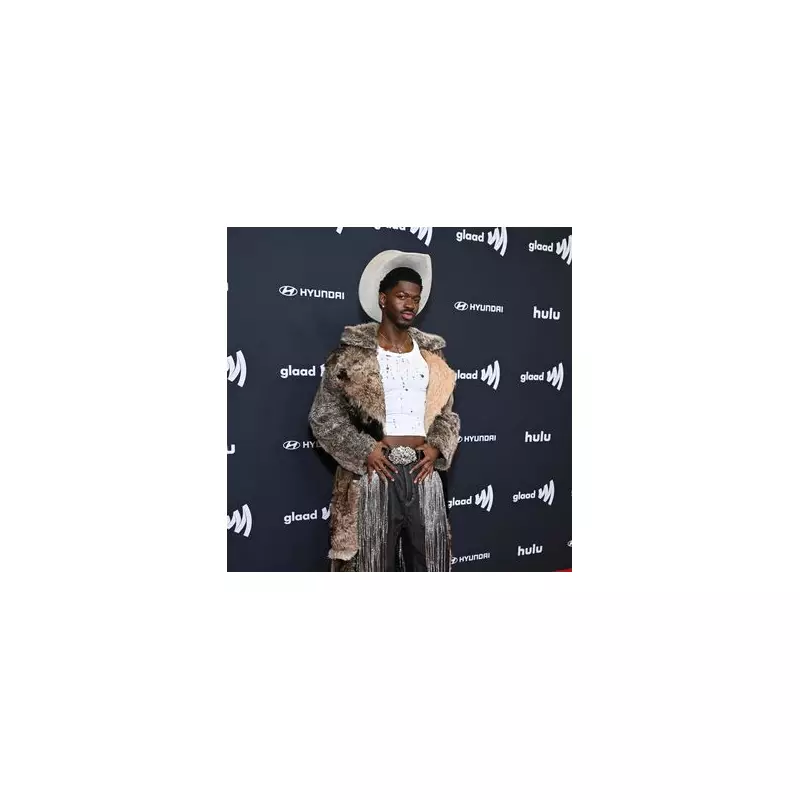

Global rap sensation Lil Nas X could be facing a staggering financial setback after UK tax authorities launched an investigation into his earnings from a British performance. HM Revenue & Customs (HMRC) is pursuing the 'Montero' hitmaker for an estimated £80,000 in unpaid taxes.

The controversy stems from his headline performance at the O2 Institute in Birmingham back in October 2022. Despite the show's success, it appears a complex tax situation has emerged between the artist's US-based team and UK tax laws.

The HMRC Investigation

According to tax experts, HMRC has been conducting a thorough examination of the financial arrangements surrounding Lil Nas X's UK appearance. The investigation focuses on whether the appropriate taxes were paid on income generated from the performance, including ticket sales, merchandise, and associated revenue.

Tax consultant David Redfern of DSR Tax Claims highlighted the seriousness of the situation: "When HMRC investigates a celebrity's tax affairs, they leave no stone unturned. For Lil Nas X, this could mean not just repaying the alleged unpaid tax but potentially facing additional penalties and interest charges."

Potential Consequences

The ramifications for the 25-year-old artist could be severe if the tax claim is validated. Beyond the immediate financial hit of approximately £80,000, failure to comply with HMRC's demands could result in:

- Substantial penalty charges on top of the owed amount

- Accrued interest on the unpaid tax dating back to the performance

- Potential restrictions on future UK performances and earnings

- Damage to the artist's financial reputation and standing

Celebrity Tax Scandals: A Growing Trend

Lil Nas X isn't the first international artist to face scrutiny from HMRC. The UK tax authority has increasingly focused on high-profile performers who generate significant income from British appearances but may not fully comply with local tax regulations.

This case highlights the complex nature of international tax law and the importance of proper financial planning for artists performing across multiple jurisdictions. Many US-based performers inadvertently find themselves facing unexpected tax bills due to differences between American and British tax systems.

As the investigation continues, representatives for Lil Nas X have yet to make an official public statement regarding the HMRC claim. The outcome of this case could set an important precedent for how international artists manage their tax obligations when performing in the UK.