Just a few years ago, £240,000 could secure a decent property across most regions of the United States. Before the pandemic struck in 2020, the national median house price had never reached that threshold. However, since COVID-19 disrupted America's property market, home values have experienced unprecedented growth, with the current median standing at approximately £330,000.

With property costs escalating alongside rising living expenses, Americans are increasingly seeking affordability in all aspects of life, including their home purchases. While many Generation Z and millennial buyers feel excluded from the market, several locations still exist where £240,000 provides substantial purchasing power.

Budget-Friendly Property Markets Revealed

A recent Realtor.com study has identified ten desirable metropolitan areas where properties remain available for under £240,000. Hannah Jones, senior economic research analyst at Realtor.com, explains: 'In these markets, home prices align more closely with local incomes, enabling typical households to afford typical for-sale properties. The existence of these affordable areas, even if limited, offers encouraging news for buyers committed to purchasing within these regions.'

The analysis highlights several Midwestern and Eastern cities where budget-conscious buyers can find value. Toledo, Ohio, earned recognition as Realtor.com's top spring 2025 property market. Situated just 60 miles from Detroit, Toledo boasts a vibrant arts scene alongside its housing affordability.

Featured Affordable Locations

Among the highlighted markets, Muncie, Indiana, offers outdoor enthusiasts 750 acres of reservoir space for boating, hiking, and cycling, while being merely an hour from Indianapolis. Battle Creek, Michigan, provides a friendly, close-knit community atmosphere with convenient positioning between Chicago and Detroit.

The list extends to include several other cost-effective metropolitan areas:

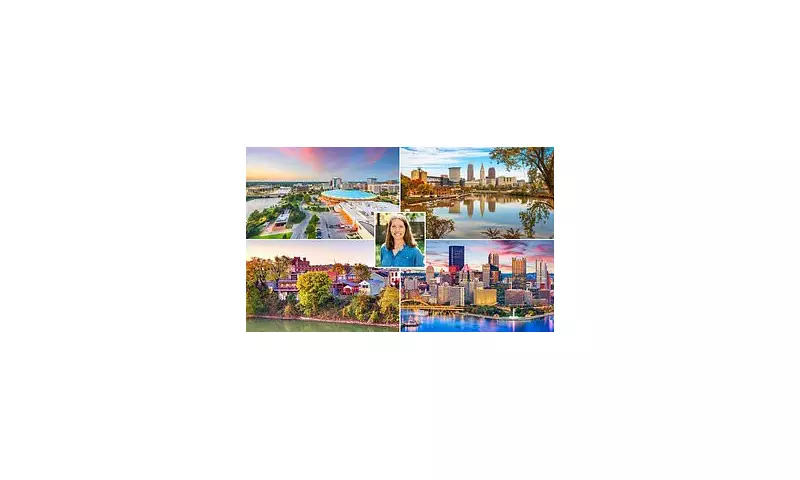

- Pittsburgh, Pennsylvania: A tech-savvy city blending historic industrial character with leafy neighbourhoods and world-class museums

- Cleveland, Ohio: A culture-rich Great Lakes city combining arts, cuisine, and waterfront living

- Scranton-Wilkes-Barre, Pennsylvania: Northeastern Pennsylvania's industrial heritage meets small-city charm and mountain scenery

- Buffalo-Cheektowaga, New York: Western New York hub offering snowy winters, quality dining, and passionate sports culture

Additional markets making the cut include Wichita, Kansas, with its aviation heritage and growing arts community; Frankfort, Kentucky, featuring historic riverfront charm and bourbon heritage; and St. Louis, Missouri, renowned for iconic architecture and rich musical history.

Regional Affordability Patterns Explained

The research reveals that all identified affordable markets cluster within America's Midwest and Eastern regions. Property prices typically remain more accessible in these areas compared to Southern hotspots and particularly the West Coast due to several structural factors.

The Midwest and parts of the East benefit from extensive flat, buildable land with fewer geographical constraints. Conversely, West Coast development faces limitations from mountains, coastlines, and protected areas restricting construction opportunities.

While the South generally possesses more available land, rapidly expanding metropolitan areas like Austin, Nashville, and Atlanta are quickly consuming central locations. The Midwest and East experience slower population growth, resulting in reduced housing demand compared to Southern regions witnessing substantial inbound migration that drives prices upward.

West Coast markets maintain consistently high demand due to favourable climate, economic opportunities, and lifestyle appeal. Additionally, property prices in highlighted affordable metros correspond with lower wages and reduced living costs associated with fewer high-paying positions in technology, finance, and entertainment sectors.

Higher salaries on the West Coast—home to Silicon Valley and Hollywood—significantly influence property values. Similar patterns emerge in Southern states like Florida, Texas, and South Carolina, where living costs increase alongside growing demand.