Global stock markets experienced a dramatic £200 billion rebound on Thursday after the chief executive of the world's most valuable company, Nvidia, dismissed mounting concerns about a potential artificial intelligence bubble.

Nvidia's Stellar Performance Defies Expectations

The US technology giant, whose processors are fundamental to the development of artificial intelligence, announced that its sales had skyrocketed by 62% to £43.6 billion in the three months to the end of October. This impressive performance came during a period of significant market anxiety about overvalued tech stocks.

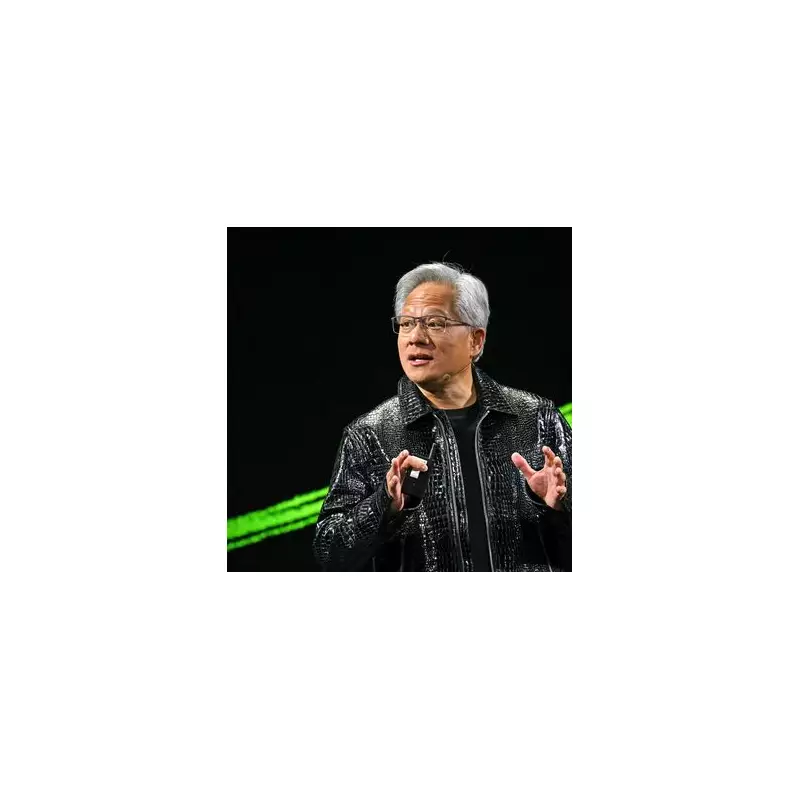

Jensen Huang, Nvidia's chief executive, directly addressed these fears, stating: "There has been a lot of talk about an AI bubble. From our vantage point we see something very different." His confident remarks provided the reassurance investors had been desperately seeking after weeks of volatility that had wiped hundreds of billions from technology company valuations.

Global Markets Respond with Widespread Gains

The announcement triggered an immediate rally across international financial markets. The FTSE All World Index, which represents the bulk of global stock markets, climbed 0.3%. In the UK, the FTSE 100 jumped nearly 70 points by mid-morning trading, although it remains below the near 10,000 mark it achieved just last week.

The positive sentiment spread to Nvidia's rivals, boosting shares in Google's parent company Alphabet and Microsoft. Ben Barringer, from asset manager Quilter Cheviot, commented: "This is just what the market wanted after a nervous couple of weeks. Nvidia has done well to assuage any fears that it was beginning to slow its growth."

Mixed Reactions from Market Analysts

While the results brought temporary relief, some experts cautioned that underlying concerns about sustainability persist. Ruben Roy, an analyst from investment bank Stifel, noted: "The concern that AI infrastructure spending growth is not sustainable is not likely to ebb."

Other analysts offered more measured optimism. Chris Beauchamp, chief market analyst at IG, said: "While bubble fears won't be completely dispelled by Nvidia earnings, signs of robust demand mean that investors are able to see the upside from here." Russ Mould of AJ Bell provided a particularly British analogy, describing Nvidia's figures as being "as comforting as a warm cup of tea on a cold day."

Victoria Scholar at Interactive Investor highlighted the significance of beating already high expectations, stating the results had "silenced the bears" and put the "AI bulls back on the front foot." She acknowledged the challenging November for AI stocks, during which prominent investors including Michael Burry and Softbank had turned against them, but suggested Nvidia's performance indicates the high valuations might be justified.