A startling discovery has revealed that Australian drivers who identify as non-binary can save hundreds of pounds a year on their comprehensive car insurance, prompting widespread discussion about insurance pricing models.

The Discovery That Shocked a Radio Host

The revelation came to light during a segment on Radio 2GB, when host Ben Fordham spoke with a 22-year-old listener, also named Ben. The young driver explained how he had been shopping for car insurance and decided to experiment with the gender identity options on the NRMA insurance website.

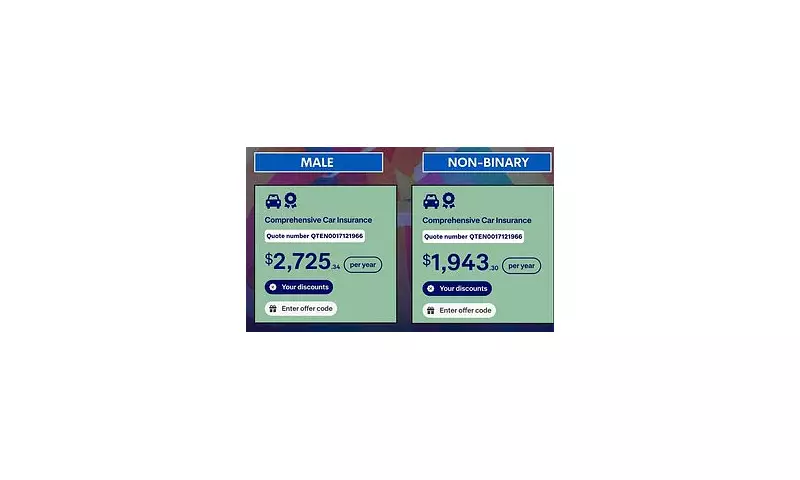

'I found the box on there and thought I'm just going to give it a tick and see what it comes out with, you know, it might be a bit of a joke,' he told the programme. To his astonishment, his annual comprehensive car insurance quote plummeted from $2,700 to $1,900 – a saving of $800 – simply by selecting 'non-binary' instead of 'male'.

Fordham was left speechless by the finding, responding simply: 'I can’t believe it.' The listener remarked, 'A joke is right, I was absolutely stunned at what I found.'

Confirmed Trend Across Major Insurers

The Daily Mail has since verified this trend through its own investigation. For a 25-year-old driver insuring a 2016 Hyundai i30, a comprehensive policy cost about $700 less for a non-binary customer compared to a male one. The price dropped from $2,354 per year to $1,678.

The same policy for a female customer was quoted at approximately $1,970. Meanwhile, Allianz comprehensive car insurance quotes also proved lower for non-binary customers than for males. However, unlike NRMA, Allianz's quotes for non-binary and female applicants appeared identical.

This pricing disparity highlights a significant financial incentive. As the original listener noted, 'just tick the non-binary box, because no-one is going to be able to disprove how you identify, you’re going to get a better deal.'

Industry Justifications and Data Gaps

The insurance industry has historically justified costlier policies for male drivers, particularly younger ones, based on statistical data showing they are more likely to be involved in accidents. Finance comparison site Mozo found men pay about 17 per cent more for car insurance, though this gap narrows with age.

Supporting this, research from the University of New South Wales in 2021 found male drivers in NSW are more likely to crash for up to 13 years after attaining their licence.

However, Professor Rebecca Ivers, head of UNSW's School of Population Health, has highlighted a critical data gap. 'Because current data is generally limited to binary notions of sex, there is a critical need for more nuanced research that investigates the gendered dimensions of mobility, transport and safety,' she said.

While the difference is clear for males and females, data on the impact of gender identity, as opposed to sex, remains scarce. Other major insurers, including AAMI, GIO and QBE, currently only offer male and female options, without a specific box for non-binary applicants.

Both AAMI and GIO's websites include notices inviting customers who do not identify as male or female to 'select the gender you are most comfortable with', adding they are reviewing their systems. The public reaction has been swift, with many on social media declaring they would identify as non-binary when renewing their insurance.