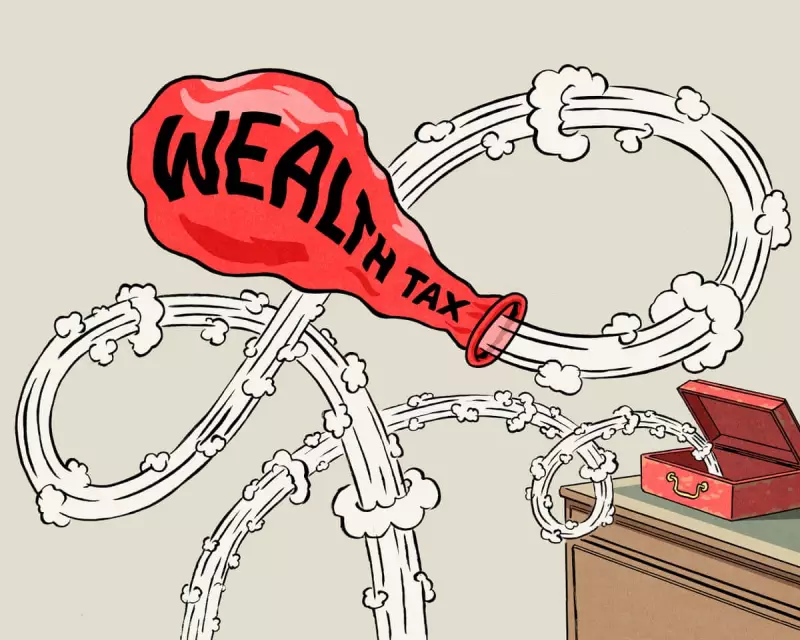

With the budget announcement looming, a consensus appears to be emerging across sections of the British left: the solution to funding public services and tackling inequality lies in implementing a wealth tax. From Labour backbenchers to trade unions and online commentators, the call to make the super-rich pay their fair share has become a rallying cry.

The Allure of Simple Solutions

Proposals vary in their specifics. The Green Party's latest manifesto advocates for a 1% annual levy on assets exceeding £10 million. This builds on the work of the Wealth Tax Commission, which in 2020 assembled extensive global evidence on the subject. The Commission had previously recommended a more dramatic one-off wealth tax on couples with assets over £1m, a move it estimated could raise a staggering £260 billion.

However, the current popular proposals are far more modest. The Commission estimated that an annual tax of 1.12% on assets above £10m would generate approximately £10 billion. While a significant sum, this represents only about 1% of annual government expenditure—a useful contribution, but in Whitehall terms, not transformative.

Beyond the Pantomime of Pseudo-Radicalism

The fundamental criticism of the wealth tax push is that it functions as political theatre—a pantomime of pseudo-radicalism that identifies villains on yachts while offering a deceptively simple solution. Experts point out that similar revenue could likely be raised by adjusting existing taxes on the wealthy, avoiding the complexity and administrative burden of creating an entirely new tax system.

This focus on a handful of billionaires also overlooks a much broader base of wealth inequality. Well-to-do families across the country, particularly those in property hotspots like inner-London boroughs such as Hackney, have seen their housing wealth skyrocket since the late 1990s. An ordinary terrace house in such areas can now fetch close to £1 million, more than three times the average across England.

The Path to Meaningful Economic Change

Genuinely addressing inequality requires more profound, systemic reforms than a surface-level wealth tax. Meaningful change would involve:

- Reforms to labour laws to encourage trade union organisation and collective bargaining.

- Corporate restructuring to give workers a greater stake in the businesses they help build.

- A major programme of social housebuilding to address the housing crisis at its root.

The irony, as noted by some observers, is that past Labour leadership under figures like Ed Miliband championed the concept of predistribution—ensuring citizens receive a fairer share of assets before taxation even occurs. On this measure, the party that contested the 2015 general election appeared more economically radical than some of its current counterparts.

The political appeal of the wealth tax is understandable. In a low-growth Britain, political battles are increasingly about the distribution of resources rather than promises of expanding the overall economic pie. This is a reality that centrist politicians across both major parties have been slow to acknowledge, contributing to the anticipated disappointment of next week's budget. While the instinct to make the wealthy contribute more is correct, the tools for building a fairer economy may be more complex than they first appear.