New data reveals a deepening financial strain for the majority of British households, with spending power declining for the fourth month in a row as the nation awaits Chancellor Rachel Reeves's October Budget.

The latest Income Tracker from Asda, compiled by the Centre for Economics and Business Research (Cebr), shows that low and middle-income families, constituting 60% of all households, are experiencing a continued squeeze on their discretionary funds compared to a year ago.

A Widening Gap Between Earners

The financial pressure is not felt equally. The report, which analyses data for the year to October, found that families in the bottom three income brackets saw their earnings growth outstripped by increases in tax payments and the cost of essential items like food, housing, and utilities.

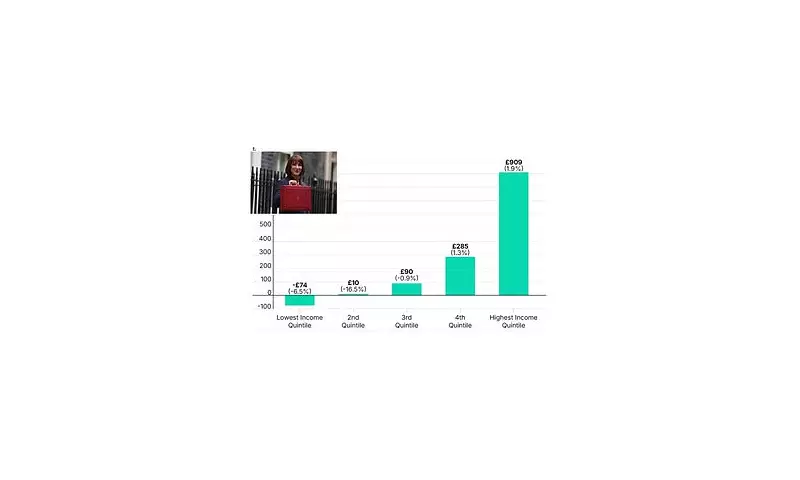

For the lowest 20% of earners, who have a mean income of £11,000, the situation is most dire. They ended each week with a £74 shortfall, meaning their income could not cover essential bills. This represents a 7% deterioration from the previous year.

The second lowest 20% of earners (mean income: £25,000) were left with just £10 per week after essentials, a worrying 17% drop. Those in the middle fifth (mean income: £41,000) had £90 remaining, a marginal fall of 1%.

In stark contrast, higher earners saw their position improve. The top 20% of households (mean income: £137,000) finished each week with £909 of disposable income, a 2% annual increase. The second highest quintile (mean income: £66,000) had £285 left, a slight 1% rise.

Essential Costs Outpacing Inflation

A key driver of this disparity is the disproportionate impact of essential spending. For lower-income households, a larger share of their budget goes towards necessities, and these costs are rising faster than overall inflation.

The study revealed that essential costs rose by 4.6% year-on-year for the average household. This has hit younger people particularly hard; those under 30 dedicate a massive 69% of their gross income to essential spending, partly due to high rental costs.

Households aged 30 to 49 faced the highest absolute essential spend at £799 per week, alongside tax payments of £281. This age group also had the highest average weekly gross income at £1,384.

Economic Outlook and Budget Concerns

Sam Miley, Head of Forecasting and Thought Leadership at Cebr, issued a cautious warning. While inflationary pressures may have peaked, significant risks remain.

"Worse than expected labour market figures for September illustrate that the UK labour market has been weakened by raised employment costs and weak demand," Miley stated.

He also highlighted the potential for further pressure from the upcoming Budget, stating, "Prospects for the UK economy are also not helped by the high likelihood of fiscal contraction in the November Budget. With households and business alike nervously waiting to see how much of the fiscal burden will be placed on their shoulders, there could well be risks ahead for the income tracker."

Overall, the income tracker recorded annual growth of 1.3% in October. However, it fell by £1.01 month-on-month, and the average household's purchasing power now stands at £253 per week—the same level as in December of the previous year.