Official figures due next week are forecast to reveal a modest uptick in UK economic growth for October, driven largely by a recovery in manufacturing spearheaded by carmaker Jaguar Land Rover (JLR).

Manufacturing Rebound Offsets Pre-Budget Uncertainty

Economists anticipate that a rebound in factory output, particularly in the automotive sector, provided a crucial lift to the economy last month. This comes despite reports that business activity slowed in the lead-up to the Autumn Budget on November 26, as speculation over potential tax measures caused some firms and consumers to delay spending.

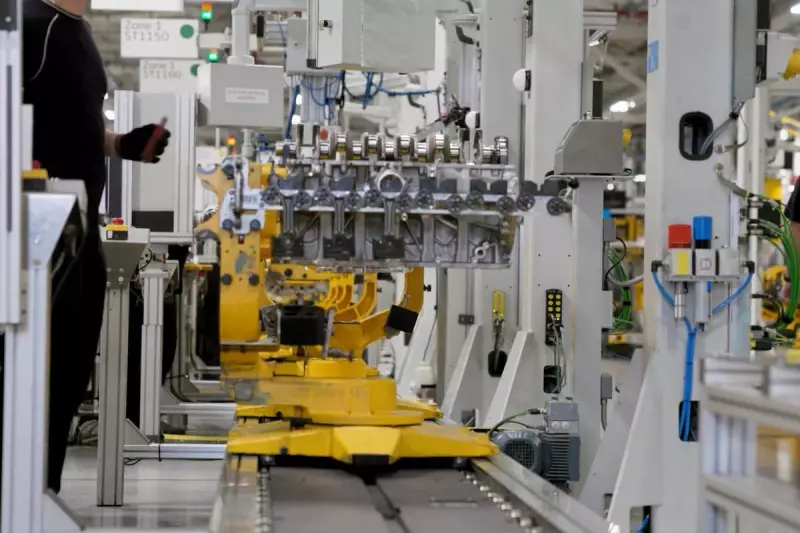

The Office for National Statistics (ONS) will publish its preliminary estimate for UK gross domestic product (GDP) on Friday, December 12. This follows data showing the economy contracted by 0.1% in September, a dip the ONS attributed partly to a "marked fall" in car production after a cyber attack crippled JLR's operations.

From Cyber Attack to Partial Recovery

The luxury car manufacturer was forced to halt production for over a month after being targeted by hackers, causing significant disruption across the supply chain. Andrew Goodwin, chief UK economist at Oxford Economics, noted that with production resuming gradually from mid-October, a partial rebound was likely.

"Given that production resumed gradually from mid-October, there’s likely to have been a partial rebound in manufacturing output that month," Goodwin said. He predicts a flat performance from the dominant services sector will result in overall GDP growth of 0.1% for October.

Economists Forecast Cautious Optimism

Analysts at Investec are slightly more optimistic, forecasting a 0.2% increase for October. They stated this figure is "consistent with our view that the economy will have expanded by close to 1.5% over 2025 as a whole."

The forthcoming data will be scrutinised for signs of how deeply pre-Budget uncertainty affected economic activity. Former Bank of England chief economist Andy Haldane recently suggested that prolonged speculation and leaks over possible tax hikes had "caused businesses and consumers to hunker down," weakening third-quarter data.

Business surveys had indicated firms were deferring investment and noting household hesitancy on major purchases ahead of the fiscal statement. However, the S&P Global purchasing managers' index showed the private sector returned to growth in October, with manufacturing activity expanding again.

While the JLR-led recovery in manufacturing is a positive sign, economists warn that underlying economic momentum remains fragile as the UK navigates a complex fiscal and economic landscape.