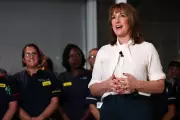

Council funding formula shifts cash to 'deprived' areas

A new 'fairer' funding system for England will divert central cash to the most deprived areas, pressuring councils in London and the South East. Five London boroughs will see council tax caps removed.