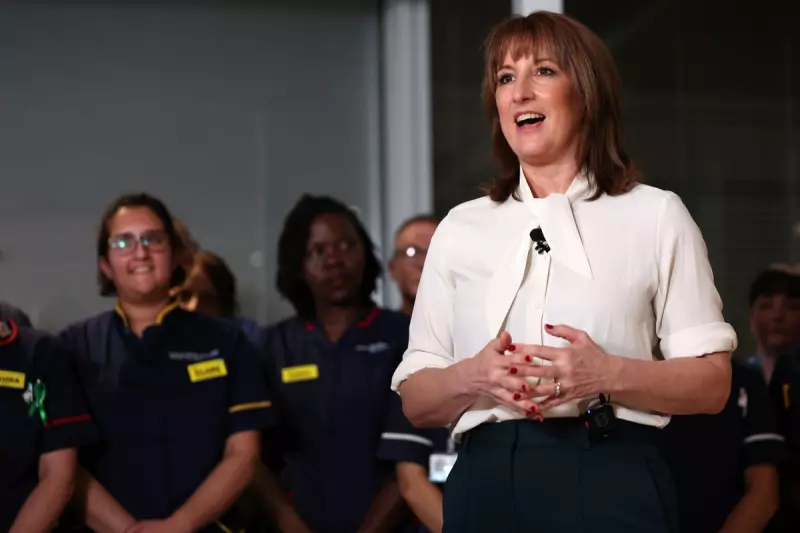

Chancellor Rachel Reeves has struck a defiant tone following her first Budget, insisting that taxes have been kept at an "absolute minimum on ordinary working people" despite analysis projecting Britain's tax burden will reach a record high.

A Defiant Stance on Tax and Spending

The Chancellor robustly defended her fiscal plans on Thursday, telling critics: "You're not going to write my obituary today." Her comments came a day after delivering a Budget she stated she was "incredibly proud" of, which included £26 billion in tax increases.

These revenue-raising measures were deemed necessary after weaker-than-expected economic forecasts created significant holes in the government's previous spending plans. The funds are also required to pay for a major welfare reform: the abolition of the two-child benefit cap, a move expected to lift 450,000 children out of poverty.

"I'm not going to apologise for lifting the two-child limit," Ms Reeves stated, rejecting assertions that she was raising taxes on workers specifically to fund the rising welfare bill.

Threshold Freezes vs. Tax Rises: The Core Debate

The central controversy stems from the Chancellor's decision to freeze income tax thresholds until 2030/31, a policy that will pull more people into higher tax brackets as their earnings increase over time. This freeze is projected to create:

- 780,000 more basic-rate taxpayers

- 920,000 more higher-rate taxpayers

- 4,000 more additional-rate taxpayers by 2029/30

Ms Reeves insisted this approach did not breach Labour's manifesto commitment not to increase income tax or national insurance rates. "I do recognise that that will mean that working people pay a bit more. But I've kept that contribution to an absolute minimum," she told Sky News, pointing to the closure of tax loopholes and cuts to government waste.

However, the Resolution Foundation think tank presented a contrasting analysis. It argued that the Chancellor's adherence to her "manifesto tax pledge has cost millions of low-to-middle earners", who would have been financially better off if tax rates had risen by 1p instead of thresholds being frozen. The think tank stated that anyone with an income below £35,000 would have benefited more from a rate rise.

Other Measures and Lasting Impact

Alongside the threshold freeze, the Budget introduced several other tax changes, including:

- A new pay-per-mile tax for electric vehicles

- Increased taxes on online betting

- A so-called "mansion tax" on properties valued over £2 million

Ruth Curtice, Chief Executive of the Resolution Foundation, noted that the full impact of the Budget will be felt in 2028 when many measures, including the threshold freezes, take full effect. She described the coming decade as "really, really tough" for living standards.

The Budget was also overshadowed by an unprecedented leak of details before Ms Reeves's Commons speech. The Chair of the Office for Budget Responsibility, Richard Hughes, indicated that an "external person" may have been responsible for the premature publication. While Ms Reeves said she retains confidence in Mr Hughes, she added that the early release "did let me down" and "it must never happen again."