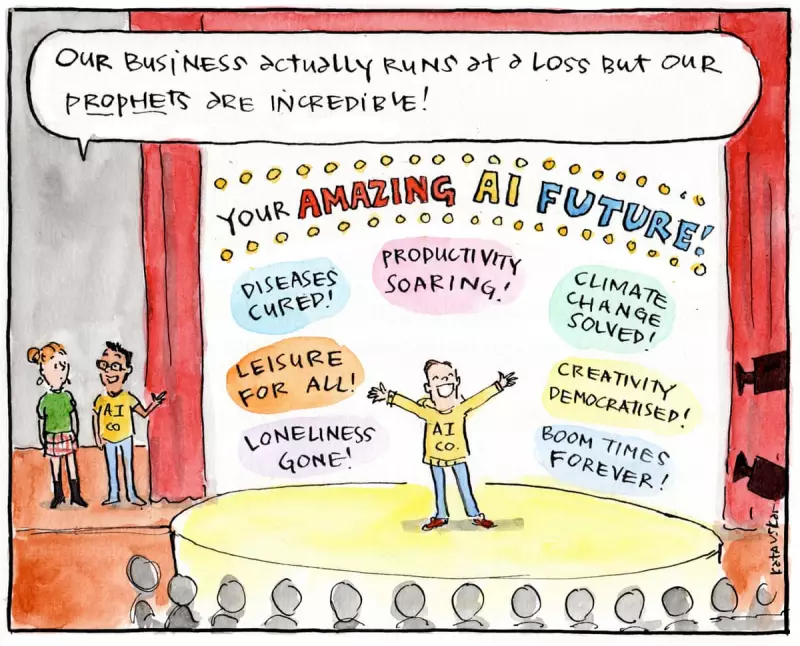

The relentless drumbeat from Silicon Valley's AI evangelists promises nothing short of an economic revolution, with astronomical financial returns just around the corner. But a growing chorus of sceptics, including economists and industry veterans, is urging a more cautious, clear-eyed approach.

Proponents of artificial intelligence paint a picture of unprecedented productivity gains and a massive windfall for early investors. The narrative is compelling: AI will automate complex tasks, unlock new creative frontiers, and generate wealth on a scale never seen before.

The Case for Caution: A Reality Check

However, this unbridled optimism often glosses over significant hurdles. Critics point to several critical factors that could dampen the financial euphoria:

- Immense Operational Costs: The computational power required to train and run advanced AI models is staggeringly expensive, eating into potential profits.

- Market Saturation & Hype: The market is becoming crowded with startups and established firms all vying for a piece of the AI pie, potentially leading to a speculative bubble.

- The Unproven Business Model: While the technology is impressive, generating consistent, large-scale revenue from many AI applications remains an unproven challenge.

Beyond the Hype: A Measured Future

The truth likely lies somewhere between the two extremes. Artificial intelligence is undoubtedly a transformative technology that will reshape industries. The key for investors, policymakers, and the public is to navigate the space with healthy scepticism, distinguishing genuine, sustainable innovation from mere hype. The future of AI may be bright, but it probably won't be a get-rich-quick scheme for all.