Entertainment

Camila Cabello Celebrates 29th Birthday with Billionaire Beau Henry Junior Chalhoub

Cuban-American singer Camila Cabello marked her 29th birthday with a lavish cake and rare public appearance with billionaire boyfriend Henry Junior Chalhoub after four months apart.

Sports

Lindsey Vonn's Red Bib Dream Ends After Olympic Crash, Focuses on Recovery

Skiing legend Lindsey Vonn loses FIS World Cup downhill lead after a devastating leg break at the Winter Olympics, reflecting on her remarkable comeback season.

Politics

Trump Demands Iran's Unconditional Surrender Amid Seven-Day Conflict

Donald Trump declares US military performance 'phenomenal' against Iran, demanding unconditional surrender as conflict enters seventh day with over 1,300 reported deaths.

Crime

Bangladeshi Man Extradited to Alaska for Alleged Teen Sextortion Scheme

A Bangladeshi man accused of tricking hundreds of teenage girls into sending explicit images via social media has been transported to Alaska to face federal child exploitation charges.

Business

Health

Weather

Tornado-Linked Crash Kills Mother and Daughter in Oklahoma Storms

A mother and teenage daughter died in a tornado-related car crash in Oklahoma as severe thunderstorms sweep across America's heartland, putting over 7 million at highest risk.

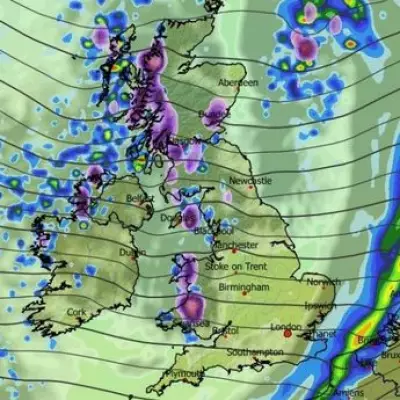

Nine-Day UK Snow Blitz: -3C Freeze to Hit Devon

Advanced weather models predict a nine-day snow event across the UK, with temperatures plummeting to -3C in Scotland and flurries reaching as far south as Devon and Hampshire.

Saharan Dust Plume Hits UK, Health Alert for Vulnerable

A rare Saharan dust plume is sweeping across the UK, prompting health warnings for asthma and COPD sufferers. Experts urge staying indoors with windows closed to avoid respiratory risks.

Met Office Gets Funny Storm Name Ideas Like Prince Andrew

The Met Office received over 50,000 storm name suggestions for 2025/26, including humorous entries like Storm Prince Andrew and Elon Gust, though serious safety purposes prevail.

Deadly Storms Hit Oklahoma, Severe Weather Threat Escalates

Severe thunderstorms have claimed lives in Oklahoma, with forecasters warning of intensified tornado risks across multiple central US states on Friday, affecting millions.

Tech

Get Updates

Subscribe to our newsletter to receive the latest updates in your inbox!

We hate spammers and never send spam

Environment

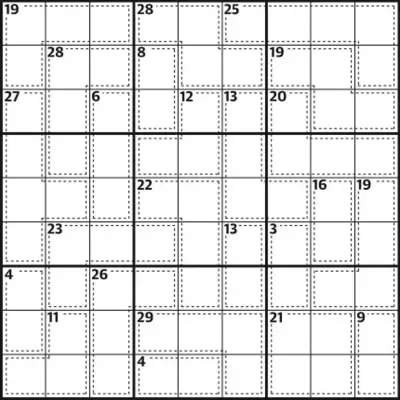

UK Geography Weekend Special

Weekend special: 100 questions about UK geography. Perfect for students preparing for exams or anyone who loves learning about Britain's diverse landscapes.