The Department for Work and Pensions (DWP) has issued a crucial reminder that certain individuals may need to proactively claim a benefit typically paid automatically. The Winter Fuel Payment is an annual, tax-free financial support designed to assist eligible older people with their heating expenses during the colder winter months.

Understanding the Winter Fuel Payment

This benefit is aimed at providing relief for pensioners facing rising energy bills. While it is usually distributed without the need for a claim, specific groups must take action to receive it. For the 2026 payment cycle, the deadline to submit a claim is set for March 31, giving recipients approximately 60 days to contact the Winter Fuel Payment Centre.

How to Apply

Applications can be made by telephone or post. To streamline the process, it is advisable to have your National Insurance number, banking details, and, if applicable, the date of your marriage or civil partnership ready. The Winter Fuel Payment Centre can be reached at 0800 731 0160, or via post to: Winter Fuel Payment Centre, Mail Handling Site A, Wolverhampton, WV98 1LR.

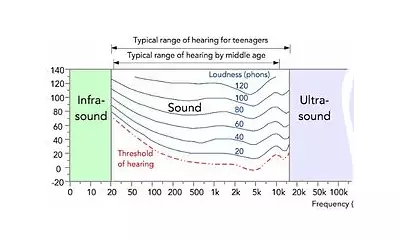

For those with hearing or speech impairments, Relay UK is available by dialling 18001 followed by 0800 731 0160. Further guidance is accessible on the official GOV.UK website.

Eligibility Criteria

To qualify for the Winter Fuel Payment, individuals must have been born before September 22, 1959, and reside in England or Wales. The amount awarded hinges on personal circumstances during the qualifying week, which spanned from September 15 to 21, 2025.

Payment Amounts

The benefit sum varies based on age and whether you live alone or with a partner who also qualifies. Generally, if you are living by yourself or no one else in your household is eligible, you could receive:

- £200 if you were born between September 22, 1945 and September 21, 1959

- £300 if you were born before September 22, 1945

For couples jointly claiming benefits such as Pension Credit, Universal Credit, or Income Support, the amounts are:

- £200 if both partners were born between September 22, 1945 and September 21, 1959

- £300 if one or both partners were born before September 22, 1945

It is important to note that this payment does not affect other benefits you may be receiving.

Who Needs to Claim?

According to government guidelines, individuals who typically need to submit a claim include those who have not previously received the Winter Fuel Payment and those who have postponed their State Pension since last receiving the benefit. This applies if you did not receive any of the following benefits during the qualifying week:

- State Pension

- Pension Credit

- Universal Credit

- Attendance Allowance

- Personal Independence Payment (PIP)

- Carer’s Allowance

- Disability Living Allowance (DLA)

- Income Support

- Income-related Employment and Support Allowance (ESA)

- Income-based Jobseeker’s Allowance (JSA)

- Awards from the War Pensions Scheme

- Industrial Injuries Disablement Benefit

- Incapacity Benefit

- Industrial Death Benefit

Deadlines and Notifications

Most eligible recipients should have received their Winter Fuel Payment automatically in November or December 2025. If you expected the payment but it has not appeared in your account, it is recommended to contact the Winter Fuel Payment Centre before January 28. However, this deadline is separate from the claim submission cutoff of March 31, 2026.

Official letters detailing the payment amount are typically sent in October or November. If you do not receive a letter but believe you are eligible, it is essential to check whether you need to make a claim.

Staying informed about these deadlines and requirements can ensure that pensioners receive the financial support they are entitled to, helping to alleviate the burden of heating costs during the winter season.