European Union leaders have finalised a major financial package for Ukraine, agreeing to provide a substantial £79 billion interest-free loan following intense negotiations in Brussels. The decision came after more than a day of talks where a prior proposal to utilise frozen Russian assets was ultimately abandoned.

From Frozen Assets to Capital Markets

The original plan had been to raise funds by leveraging some of the £180.5 billion in Russian state assets frozen across Europe, with the majority held in Belgium. However, leaders could not overcome legal and political hurdles, particularly concerns raised by Belgium. The nation's Prime Minister, Bart De Wever, warned the scheme was legally risky and could damage the Brussels-based financial clearing house Euroclear, where approximately £169.5 billion of the frozen assets are held.

Belgium's position was hardened last week when Russia's Central Bank launched a lawsuit against Euroclear to block any use of its frozen funds. "For me, the reparations loan was not a good idea," Mr De Wever stated after the summit, adding that the plan had "a lot of loose ends" and risked setting a dangerous global precedent.

A Deal Forged in Late-Night Talks

Faced with this impasse, EU leaders worked late into Thursday night to find an alternative. They eventually agreed to borrow the £79 billion on capital markets. The funds are designed to cover Ukraine's military and budgetary requirements for 2026 and 2027, a period for which the International Monetary Fund estimates Kyiv will need around £120.7 billion.

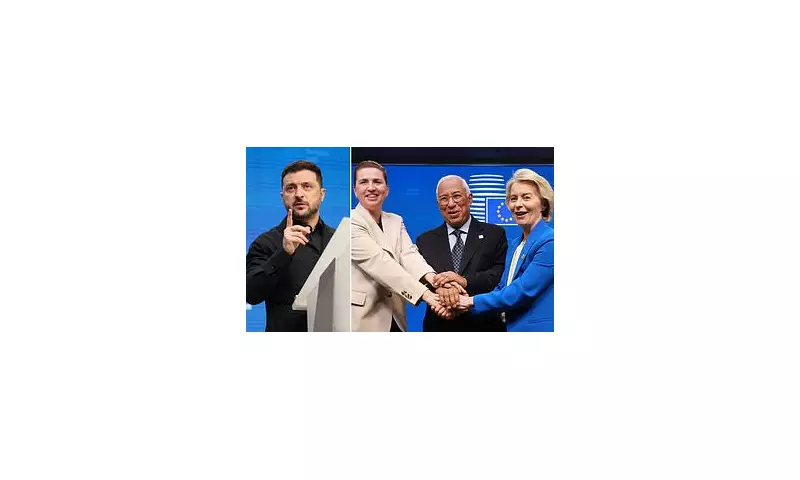

"We have a deal," announced European Council President Antonio Costa on social media. "Decision to provide 90 billion euros of support to Ukraine for 2026-27 approved. We committed, we delivered." German Chancellor Friedrich Merz confirmed the loan would be interest-free and sufficient for Ukraine's needs, while emphasising that frozen Russian assets will remain blocked until Moscow pays war reparations.

Mixed Reactions and Future Implications

Ukrainian President Volodymyr Zelenskyy, who attended the summit, expressed gratitude for the "significant support." He stressed the importance of keeping Russian assets frozen and noted the deal provides financial security. However, the agreement was not unanimous. Hungary, Slovakia, and the Czech Republic opposed the support but did not block the package, having been promised protection from any financial fallout.

Hungarian Prime Minister Viktor Orbán, a close ally of Vladimir Putin, criticised the move, stating, "To give money means war." In contrast, French President Emmanuel Macron hailed the capital markets route as the "most realistic and practical way" to fund Ukraine. While the immediate loan is secured via borrowing, EU leaders, including Mr Costa, reserved the right to ultimately use immobilised Russian assets to repay it, keeping the option on the table for the future.