A father-of-two has been pushed to the brink of financial ruin after a devastating stage 4 cancer diagnosis triggered a nightmare scenario with his bank, leaving him in over £30,000 of debt.

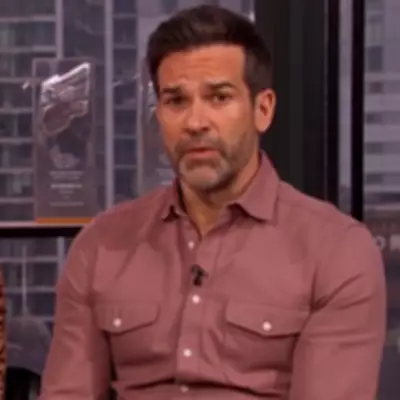

Steve Rotheram, 54, saw his world collapse when he was diagnosed with incurable bowel cancer. But his fight for survival was horrifically compounded by a financial crisis that began when his high street bank, Santander, froze his account without warning.

The financial nightmare began when Mr. Rotheram, too ill to work, tried to switch his benefits to a new account. This routine action was flagged as suspicious activity, leading Santander to immediately freeze all his assets. He was left completely penniless, unable to pay for groceries, fuel, or even his cancer medication.

"I was in tears on the phone to them," Steve recounted. "I'm fighting for my life and I had to beg for access to my own money. The stress was unbearable."

A Mountain of Debt from a Single Diagnosis

His story exposes the terrifying hidden cost of a cancer diagnosis in the UK today. Forced to stop working as a lorry driver, Steve and his wife Linda watched their income vanish overnight.

They were forced to take on a staggering £31,000 in debt to survive, covering:

- Critical private medical treatments and scans

- Soaring energy bills from being at home constantly

- Increased cost of special diets and nutrition

- Essential travel to and from hospital appointments

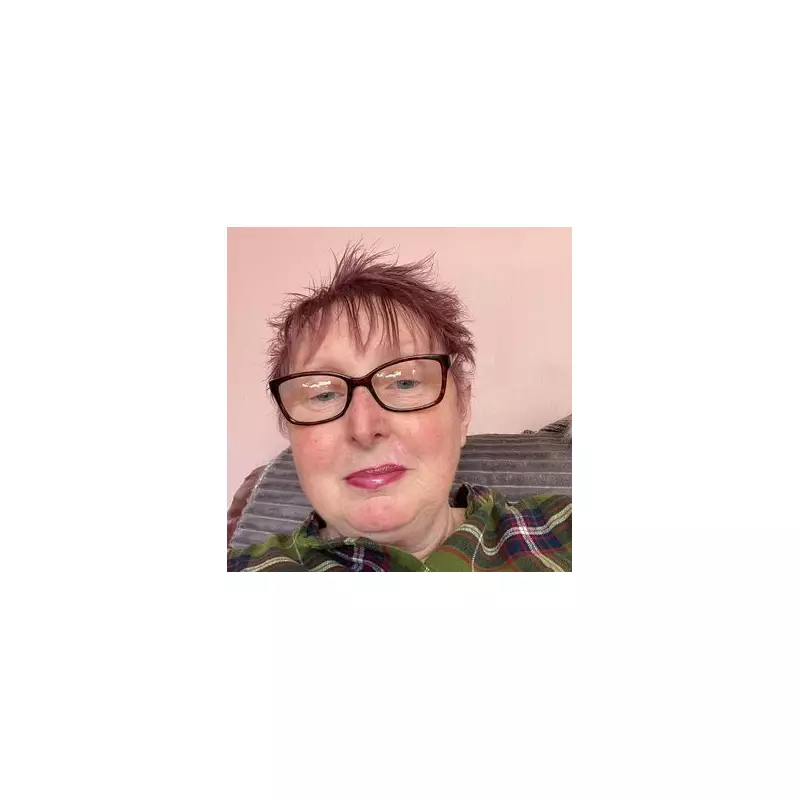

"The system is not set up to help people like us," Linda explained. "You're suddenly on a lower income but your bills skyrocket. You're trying to survive, but you're also trying to fund surviving."

A Call for Change and Support

The couple's experience is tragically common. Macmillan Cancer Support estimates that four out of five cancer patients are hit with an average cost of £900 a month just from being diagnosed. The charity has issued urgent warnings about a "cost of cancer crisis" running parallel to the cost of living crisis.

Following intervention from Macmillan's financial guidance team, Santander eventually unlocked Steve's account and offered £500 in compensation, admitting their handling of the case "fell below the usual high standards."

Steve's fight continues, both against his illness and the financial burden it created. His story is a stark reminder that the impact of cancer is far more than physical—it's a financial earthquake that shatters lives without warning.