Water Companies' Multi-Billion Green Bond Issuance Amid Pollution Scandals

England's privatised water industry has issued a staggering £10.5 billion in green bonds since 2017, despite maintaining what critics describe as an appalling environmental record during the same period. According to financial analysis by Unearthed, Greenpeace UK's investigative unit, water companies accounted for nearly one-fifth of all corporate green bond issuance in the UK between 2017 and 2025.

Leading Issuers and Their Environmental Records

The analysis reveals that Anglian Water emerged as the industry's largest green bond issuer at £3.5 billion, while the troubled Thames Water followed closely with £3.1 billion in green bond issuance. These figures positioned the two companies as the third and sixth largest corporate green bond issuers across all UK sectors since 2017.

Green bonds are specifically designed to finance projects with environmental benefits, including renewable energy, greenhouse gas control, and sustainable water management. Companies typically benefit from lower borrowing costs through these instruments, as they attract investors seeking both environmental impact and financial returns.

However, this substantial green financing occurred against a backdrop of persistent criticism regarding the industry's environmental performance. The privatised water sector in England and Wales has faced repeated allegations of underinvestment and excessive dividend payments to shareholders, coupled with ongoing sewage pollution incidents.

Growing Criticism and Allegations of Greenwashing

James Wallace, chief executive of the clean water campaign group River Action, delivered a scathing assessment of the situation. "This is corporate greenwash on steroids," he stated. "UK water companies are raising billions through green bonds while failing to deliver the environmental improvements these funds are supposed to support."

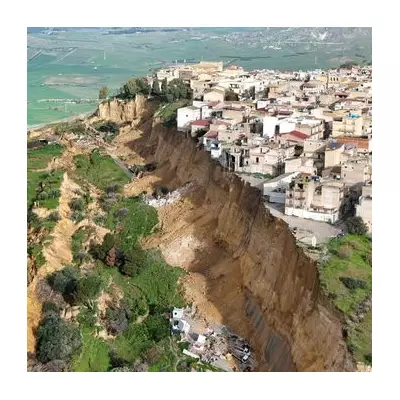

Wallace further emphasised that "their crumbling infrastructure continues to kill rivers and put communities at risk while investors are rewarded. True green finance should deliver real benefits for the environment and public health, not mask ongoing pollution."

The concerns gained additional weight when the UK government's Environment Agency reported last month that environmental progress across the water sector had actually declined in the past year. This deterioration occurred despite the sector's extensive green bond issuance.

Transparency Failures and Regulatory Challenges

Unearthed's investigation uncovered specific transparency issues, particularly with Thames Water. The company has failed to publish impact reports detailing the environmental benefits of its bonds for two consecutive years, contravening industry standards though not legal requirements.

A Thames Water spokesperson acknowledged the lapse, stating: "The impact report for 2022-23 and 2023-24, which will detail the allocation of the £1.65 billion raised through our January 2023 green bond issuance, has not yet been published. We take our reporting responsibilities seriously, and on this occasion we have fallen short of meeting expectations."

Meanwhile, Thames Water's owners are reportedly seeking government leniency on environmental standards for up to 15 years as part of a proposed rescue plan for the financially strained utility.

An Anglian Water spokesperson defended their position, arguing that growing the economy while reducing pollution requires "significant and sustained investment in infrastructure." The spokesperson added that raised funds had "helped to deliver significant environmental improvements" and pointed to carbon emission reductions as evidence of progress.

The industry's proportion of green bond issuance rises to 22% when including the Thames Tideway "super sewer" development, highlighting the water sector's dominant role in the UK's sustainable finance market. Water UK, the industry's lobbying organisation, declined to comment on the findings.