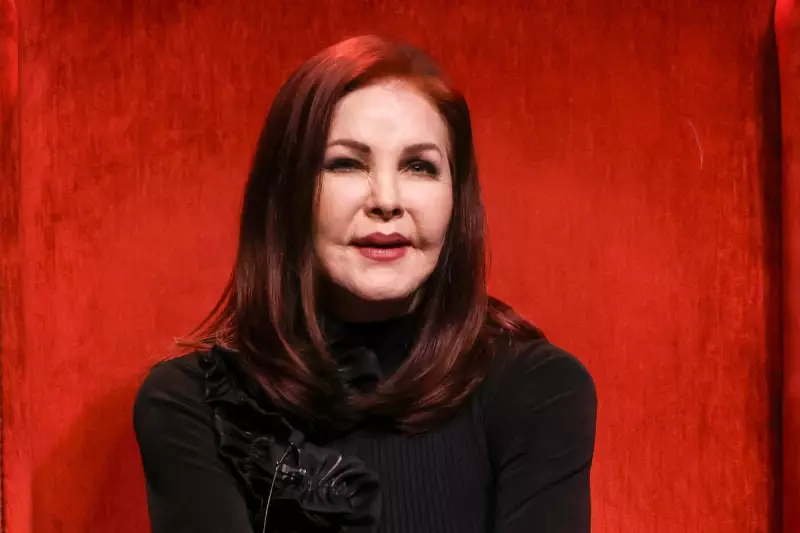

Priscilla Presley, the former wife of music legend Elvis Presley, finds herself embroiled in a significant legal confrontation with the United States Internal Revenue Service (IRS) concerning the valuation of the King's deeply personal jewellery collection.

The dispute centres on what the IRS claims was a substantial undervaluation of these historic items when they were transferred into a Promenade Trust, of which Priscilla and the late Lisa Marie Presley were trustees.

A Royal Tax Dispute

Court documents reveal the IRS is challenging the valuation of several iconic pieces, including the gold-and-diamond TCB ring and a gold record award for 'Burnin' Love'. The tax authority asserts these items were worth millions more than the declared $1.05 million (£835,000).

This legal action, filed in a California federal court, could leave the Presley estate facing a tax bill significantly higher than originally anticipated.

The Contested Items

Among the collection under scrutiny are some of Elvis's most personal effects:

- His iconic TCB (Taking Care of Business) ring with a diamond-set lightning bolt

- A gold record award for his hit single 'Burnin' Love'

- Elvis and Priscilla's original wedding bands from their 1967 ceremony

- Various other items of personal jewellery owned by the music icon

The IRS maintains these pieces hold far greater cultural and financial value than was declared during the trust transfer process.

Ongoing Estate Complexities

This tax dispute emerges against a backdrop of ongoing complexities surrounding Elvis Presley's estate. Following the tragic passing of Lisa Marie Presley in 2023, the management and valuation of the Presley legacy has come under increased scrutiny.

The outcome of this case could set important precedents for how celebrity memorabilia and historically significant personal items are valued for tax purposes.

Representatives for Priscilla Presley have not yet made public statements regarding the IRS lawsuit, leaving many questions unanswered about how this financial battle will unfold.