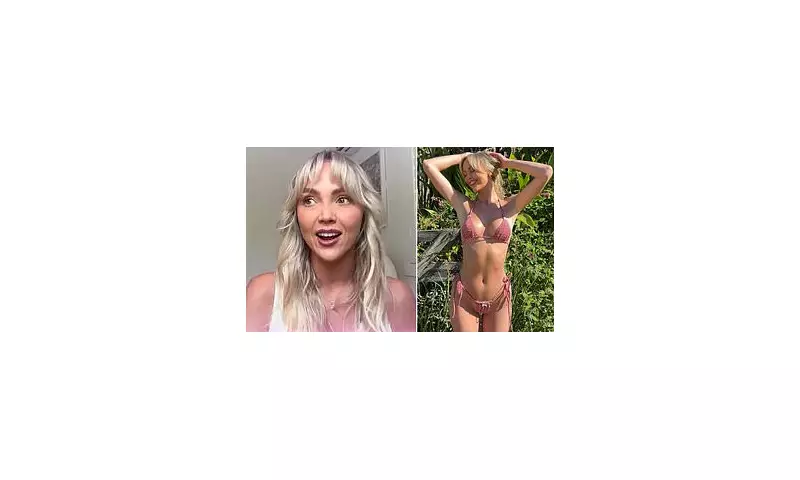

In a revelation that's raising eyebrows among accountants and digital creators alike, Australian OnlyFans sensation Annie Knight has disclosed the intimate and personal items she's attempted to claim as legitimate business expenses on her tax returns.

The adult content creator, who boasts an impressive following across social media platforms, recently shared details that blur the lines between personal and professional spending in the rapidly evolving digital entertainment industry.

The Most Controversial Claims

Knight's attempted deductions include items that would make traditional business owners do a double-take:

- Sex toys and intimate accessories used in content creation

- Designer lingerie and provocative outfits

- Cosmetic procedures including breast enhancements

- High-end beauty products and skincare regimens

- Luxury hotel stays marketed as 'content creation locations'

The Tax Office Perspective

While some of these claims might seem outrageous to the average taxpayer, the Australian Taxation Office (ATO) has specific guidelines for what constitutes legitimate business expenses for content creators. The fundamental requirement remains that expenses must be directly related to earning assessable income.

"The key question is whether these expenses would have been incurred regardless of the business activity," explains a tax specialist familiar with digital content creators. "Personal grooming and general clothing typically don't qualify, but items exclusively used for content creation might have a stronger case."

The Grey Area of Digital Entrepreneurship

Knight's revelations highlight the ongoing challenges tax authorities face in keeping pace with the booming creator economy. As more individuals generate income through platforms like OnlyFans, Instagram, and TikTok, the boundaries of legitimate business expenses continue to be tested.

The ATO has been increasingly focused on the digital creator space, issuing specific guidance about what can and cannot be claimed. Their position emphasizes that expenses must be directly connected to income generation, not merely beneficial or indirectly related.

Industry Reaction and Precedents

Other content creators have reacted with both amusement and concern to Knight's disclosures. Some see it as pushing boundaries in an industry that's still defining its norms, while others worry it could lead to stricter scrutiny for all digital creators.

Previous cases have seen mixed outcomes, with some creative deductions being allowed while others were firmly rejected by tax authorities. The distinction often comes down to whether the expense is exclusively for business purposes or serves dual personal and professional functions.

As the digital economy continues to evolve, Knight's tax confession serves as both entertainment and a cautionary tale for content creators navigating the complex world of business deductions.