In a significant blow to organised financial crime, the National Accountability Bureau (NAB) has dismantled a sophisticated fake loan scam operation that preyed upon unsuspecting victims through elaborate deception tactics.

The Elaborate Fraud Uncovered

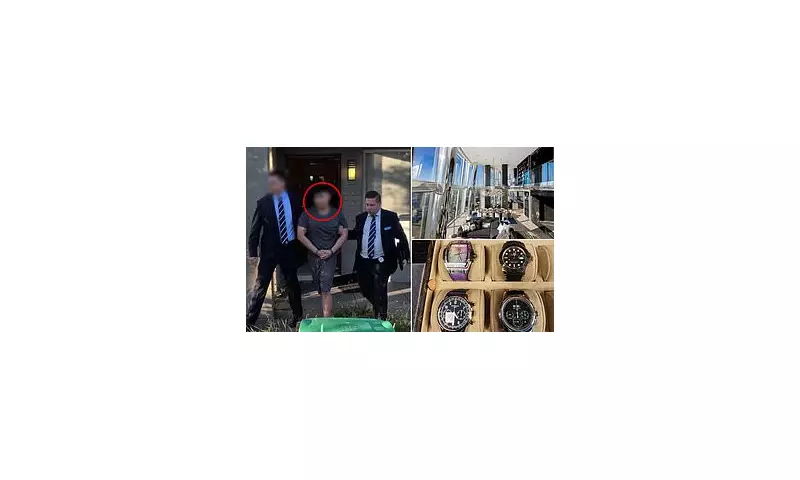

Authorities have confirmed multiple arrests following an intensive investigation into the criminal network, which operated a complex web of fraudulent loan schemes. The suspects allegedly created convincing fake financial institutions and online platforms to lure victims with promises of easy credit and favourable terms.

The sophisticated operation involved multiple layers of deception, including:

- Fake banking websites and mobile applications

- Fabricated loan approval documents

- Professional-looking marketing materials

- Call centres staffed by impersonators posing as bank officials

How the Scam Operated

Investigators revealed that the criminal group employed psychological manipulation techniques to gain victims' trust. They would initially request small processing fees, gradually escalating demands for additional payments under various pretexts including insurance premiums, security deposits, and tax clearances.

"This was not a simple fraud operation," explained a senior NAB official. "The perpetrators had developed an entire ecosystem of deception, complete with fake customer service representatives and forged documentation that appeared completely legitimate to the untrained eye."

Widespread Impact and Investigation

The scale of the operation suggests hundreds, potentially thousands, of victims may have been defrauded across multiple regions. Financial analysts estimate the total losses could run into millions of pounds, though the full extent remains under investigation.

NAB's financial crime unit employed advanced digital forensics to track the money trail through multiple bank accounts and payment platforms. The investigation uncovered evidence of sophisticated money laundering techniques designed to conceal the illicit funds.

Protecting Yourself from Loan Scams

Financial authorities urge consumers to exercise extreme caution when applying for loans online. Key warning signs include:

- Requests for upfront payments before loan disbursement

- Unsolicited loan offers via text or social media

- Pressure to make immediate decisions

- Unusually favourable terms without credit checks

- Communication through unofficial channels

The breakthrough in this case represents a significant victory for financial crime enforcement and serves as a stark warning to other organised fraud networks operating in the digital space.