In a landmark shift for the global technology industry, Apple is poised to surpass Samsung as the world's leading smartphone manufacturer for the first time in 14 years, according to new industry analysis.

The Numbers Behind the Power Shift

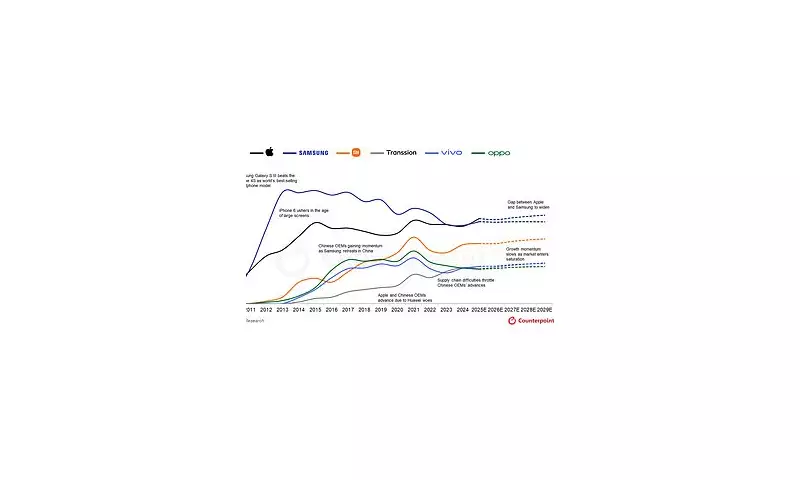

Research from Counterpoint Research reveals that Apple will ship approximately 243 million phones this year, compared to Samsung's projected 235 million units. This translates to 19.4% of the global smartphone market for Apple versus 18.7% for its Korean rival.

This represents a significant milestone for the Cupertino-based tech giant, marking the first time since 2011 that Apple has claimed the top position in global smartphone shipments. The analysts project that Apple will maintain this leadership position until at least 2029, and potentially beyond.

Driving Forces Behind Apple's Success

Yang Wang, analyst at Counterpoint Research, highlighted several key factors behind Apple's remarkable performance. The iPhone 17, released in September, has experienced "bumper" holiday season sales, exceeding expectations across multiple markets.

"We are seeing record demand coming from emerging markets like India, Middle East and Southeast Asia," Wang told the Daily Mail. "Apple has been actively working with channel partners to penetrate deeper in domestic markets, or setting up retail outlets directly."

The depreciation of the US dollar throughout the year has also played a crucial role, giving overseas consumers increased purchasing power and making premium Apple devices more accessible for those seeking "aspirational upgrades."

Regional Performance and Replacement Cycle

Sales data reveals impressive growth across key markets. In the United States, iPhone 17 series sales during the first four weeks after launch were 12% higher than the iPhone 16 series, excluding the budget iPhone 16e model.

Even more striking was the performance in China, where iPhone 17 series sales surged 18% higher than its predecessor during the same period, despite the iPhone Air not being part of the initial launch. Japan also saw a 7% increase in iPhone 17 series sales compared to the previous generation.

Wang pointed to a critical demographic shift contributing to Apple's success. "Beyond the highly positive market reception for the iPhone 17 series, the key driver behind the upgraded shipment outlook lies in the replacement cycle reaching its inflection point," he explained.

"Consumers who purchased smartphones during the Covid-19 boom are now entering their upgrade phase," creating a substantial wave of replacement demand that Apple is well-positioned to capture.

Market Dynamics and Future Projections

Apple has also benefited from lower-than-expected tariff impacts globally and a truce in the US-China trade and tech war, which had previously threatened to impose significant charges on goods imported from China, where most iPhones are manufactured.

Looking ahead, global smartphone shipments are expected to increase by 3.3% year-on-year in 2025, primarily driven by Apple's strong performance. iPhone shipments are projected to grow by 10% year-on-year, while Samsung is expected to see a "decent" 5% shipment growth.

The landscape for Chinese manufacturers presents a mixed picture. Companies like Xiaomi, Vivo, Transsion and Oppo face challenges including domestic market weakness, supply chain uncertainties, and intensifying competition.

"These companies are shifting toward higher price segments, investing in premium devices, AI capabilities and foldables to boost profitability and reduce reliance on the crowded low-end market," Counterpoint Research noted in their statement.

Apple's Future Product Pipeline

Apple's dominance appears set to strengthen in coming years with several anticipated product launches. The company is on track to launch the iPhone 17e in the first half of 2026, representing the second model in its lower-priced 'e' series.

Perhaps most anticipated is Apple's expected entry into the foldable phone market. The company is likely to release its first foldable iPhone by the end of next year, probably featuring a book-shaped design with a large internal screen.

A smaller iPhone 'flip' with a horizontal crease across the screen is projected for late 2027. This move comes despite Samsung having launched its first foldable screen phone more than six years ago.

Counterpoint Research also forecasts a "major iPhone design revamp" in 2027 to celebrate the 20th anniversary of the iPhone, with respected leaker Mark Gurman suggesting this special device will feature a curved glass screen.

Further enhancements to Apple Intelligence, the company's suite of AI tools, are expected to drive additional sales by encouraging upgrades to the latest devices, ensuring Apple's momentum continues well into the future.