Ocado has suffered another significant blow to its international expansion strategy after its Canadian partner, Sobeys, announced the closure of a robotic warehouse facility in Calgary. The decision sent shares in the UK online delivery group tumbling by almost 10% on Thursday, highlighting ongoing challenges for the company's business model.

North American Expansion Faces Setbacks

The Calgary facility closure represents the second major setback for Ocado's North American operations in just three months. This follows the decision by its US partner Kroger to close three warehouses earlier this year, which wiped almost a fifth off Ocado's market value at the time.

Sobeys attributed the closure decision to "the Alberta grocery e-commerce market's size and the rate of expansion being slower than originally anticipated." This admission suggests that Ocado's ambitious expansion plans may be encountering stronger headwinds than anticipated in certain North American markets.

Business Model Under Scrutiny

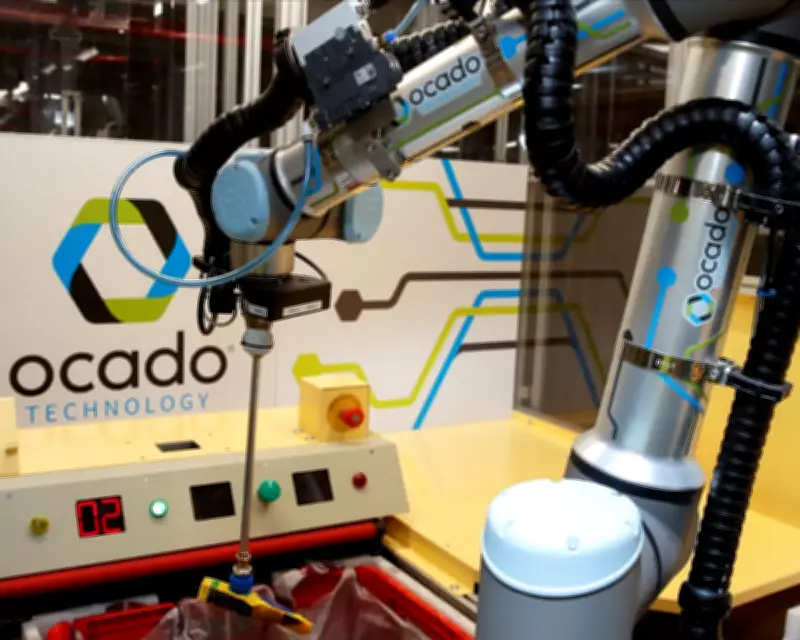

While many UK consumers know Ocado primarily as an online grocer, the company's growth strategy increasingly relies on licensing its proprietary Ocado Smart Platform technology to international partners. This sophisticated system combines advanced robotics, automation, and software to power online grocery operations for retailers worldwide.

However, this business model faces mounting challenges. Many retailers are now focusing on fulfilling orders directly from existing stores, which often proves more flexible and cost-effective than building dedicated robotic warehouses. The model also faces competition from delivery platforms like Deliveroo and Uber Eats, which utilise smaller vehicles to make deliveries directly from stores rather than centralised fulfilment centres.

Financial Implications and Compensation

Ocado expects to receive approximately £18 million in compensation for the Calgary facility closure during the current financial year. However, the company anticipates this will reduce its fee revenue by around £7 million annually.

This latest development comes as Ocado continues to report financial losses despite growing sales. The group recently announced a 13% increase in revenue to £674 million for the six months ending 1 June, but still recorded a loss of £137 million before accounting for one-off items.

Strategic Reassessment in North America

Tim Steiner, Chief Executive of Ocado Group, described the changes with both Sobeys and Kroger as representing "a reset of our North American business." He emphasised that these adjustments place the partnerships "in the best position to secure long-term growth" while reopening substantial market opportunities for Ocado's evolved technology.

Sobeys will continue serving customers through its Voilà online grocery service using two remaining customer fulfilment centres in the Greater Toronto and Montreal areas. Plans for an additional site in the Vancouver region remain on hold.

Technology Evolution and Future Prospects

The remaining Sobeys delivery centres plan to adopt Ocado's new Swift Router system, designed to handle a higher proportion of same-day and short-lead time orders. This reflects the ongoing evolution of Ocado's technology since its initial North American deployments.

Some market analysts have questioned whether Ocado's large-scale, robot-run fulfilment centres can operate economically in developed markets like the US and Canada. These concerns potentially limit the scope of the company's international expansion ambitions.

Despite these challenges, Ocado maintains that its technology partnerships represent the company's primary growth pathway. The group continues to pursue deals to supply its online shopping technology to retailers worldwide, though it faces increasing competition from rival providers in the rapidly evolving e-commerce landscape.