Two prominent office buildings in San Francisco have been sold for a mere fraction of their former value, in a stark new symbol of the city's struggling downtown core.

A Staggering Loss at Auction

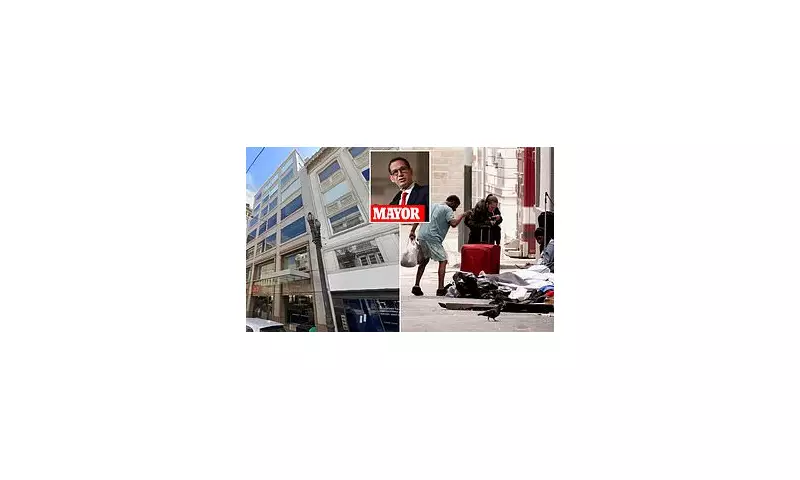

The properties at 180 Sutter Street and 222 Kearney Street were sold for just $5 million at a foreclosure auction in December. This represents a catastrophic devaluation from the $74.4 million paid for them in 2019, as reported by the San Francisco Chronicle. The buildings, situated on the edge of the Financial District and Union Square, are now emblematic of the area's rapid decline.

The ten-story and five-story buildings were burdened with an estimated $56.7 million in unpaid debt when they went to auction. Appraisals for the vacant properties had plummeted by more than 75% since their last sale, valuing them at only $18 million. The new buyer, listed as SVN Properties, LLC, acquired roughly 145,000 square feet of office space for an estimated $34.40 per square foot. This marks a drastic fall from the $515 per square foot achieved by neighbouring offices in 2019.

The Roots of the Downtown Crisis

The precipitous drop is rooted in a perfect storm of challenges that have hollowed out San Francisco's urban centre. The shift to remote work during the pandemic initiated a severe downturn, with occupancy in the Sutter and Kearney buildings dropping by 60% between 2019 and 2024. By 2025, downtown office vacancies had reached 22%.

This economic slump has been exacerbated by profound social issues. San Francisco's homeless population continued to rise in 2024, exceeding 8,000 people. Furthermore, the city's overdose crisis remained severe, with nearly 600 deaths recorded in 2025. Business owners have consistently cited rampant drug use and homelessness as key factors driving away foot traffic and forcing closures, including the shutdown of the renowned San Francisco Towne Center and numerous Union Square retailers.

Mayor's Response and Market Complexities

In response to the crisis, Democratic Mayor Daniel Lurie, elected in 2024, has made revitalising downtown a central mission. His 'Heart of the City' directive, announced in September, aims to transform the area into a vibrant neighbourhood. Lurie has leveraged over $40 million to support clean, safe streets and small businesses, claiming a 40% reduction in crime in Union Square and the Financial District during his first year.

However, analysts note that the dramatic sale price may not solely reflect property values. The San Francisco Chronicle suggests the $5 million figure could represent a 'credit bid' to facilitate the title transfer from lender Goldman Sachs to the new owner, a common practice in sparsely attended foreclosure auctions. The previous owners, Gen Realty Capitol and Flynn Properties, defaulted on their mortgage payments to Goldman Sachs in April 2024.

Whether this sale is a unique transaction or a dire indicator of the market's floor remains a subject of debate. Nevertheless, it undeniably underscores the immense pressure on San Francisco's commercial real estate sector as the city battles to recover its economic and social vitality.