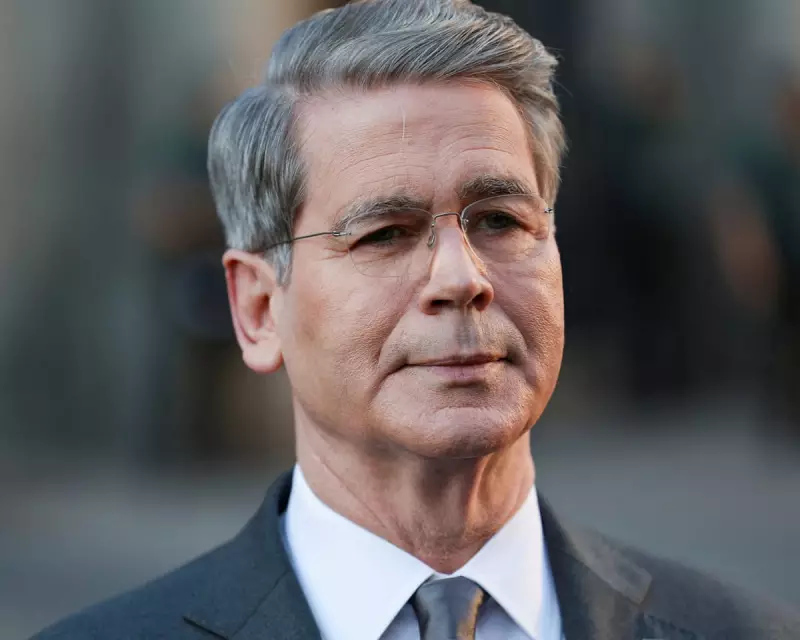

Scott Bessent, the renowned hedge fund manager and former George Soros protégé, is steering his Key Square Capital into the heart of the UK's mortgage landscape. The firm is executing a significant strategic pivot, building stakes in specialist lenders that deal primarily in loans for a borrower's main home, known as 'principal residence' mortgages.

A Strategic Bet on UK Housing Stability

This move is widely interpreted by market analysts as a major vote of confidence in the underlying resilience of the British property market. Unlike riskier buy-to-let or second-home loans, mortgages for a borrower's primary dwelling have historically demonstrated greater stability and lower default rates, even during periods of economic uncertainty.

The Key Square Approach

Rather than acquiring loans directly, Key Square's strategy involves taking strategic positions in the companies that originate these mortgages. This approach allows the fund to gain exposure to the sector's profitability while leveraging the expertise of established lending operators. The focus is squarely on firms with robust risk assessment frameworks and a strong track record in the principal residence niche.

Market Context and Implications

Bessent's manoeuvre comes at a pivotal time for the UK housing market, which has faced headwinds from rising interest rates and cost-of-living pressures. By targeting this specific segment, Key Square is betting that the fundamental need for primary housing will provide a solid foundation for returns, insulating its investments from the volatility seen in other parts of the property sector.

The involvement of a heavyweight investor like Bessent, known for his macroeconomic foresight, could also signal a longer-term belief in a stabilisation or even a recovery in the UK market, attracting the attention of other institutional investors.