A couple in their early sixties, finally mortgage-free after three decades of hard work, are facing a difficult family financial dilemma. Their son and his partner, in their late twenties, are desperate to get onto the property ladder but find the current market impossible.

The Heart of the Dilemma: Risking Hard-Won Security

Joanna and Greg have been asked by their son to consider redrawing from their home loan or taking out a new loan to fund a deposit for his first home. While part of them wants to help, having witnessed the struggles facing young buyers, they are deeply concerned about jeopardising their own financial security.

Having just reached a point where they can breathe easily, the prospect of going back into debt makes them profoundly uneasy. A significant additional worry is what would happen to their financial contribution if their son and his partner were to separate in the future.

Expert Guidance: Navigating the Safest Paths

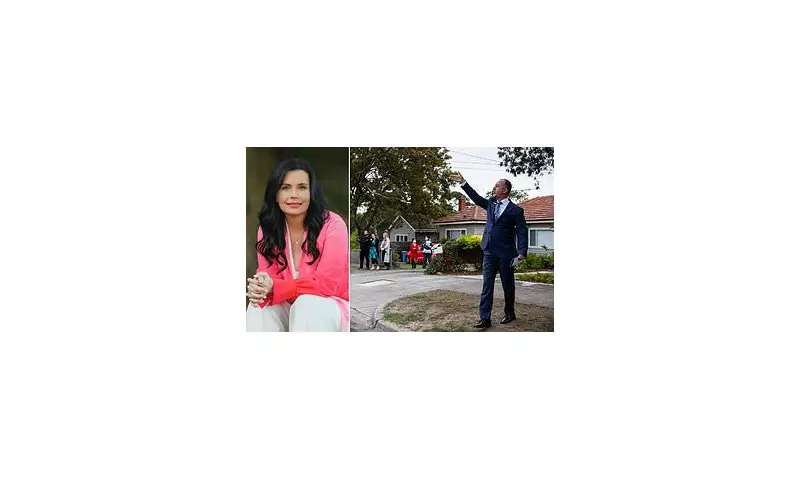

Leading money educator Vanessa Stoykov responded to their query, acknowledging that this is a quiet struggle for many parents across the UK. She affirmed that their desire to help is generous, but their caution is entirely valid.

Stoykov's first recommendation is for the couple to thoroughly understand their financial comfort zone. She advises testing the impact of different loan amounts and today's interest rates, suggesting that seeing the concrete numbers can make the decision much clearer.

Practical Strategies to Mitigate Risk

If Joanna and Greg decide to proceed, Stoykov outlines several safer approaches than simply handing over cash.

Become a Guarantor, Not a Borrower: This is often the best compromise. As a guarantor, they could use a portion of their home's equity as security for their son's loan, potentially helping him borrow more or avoid lenders' mortgage insurance, without taking on a new loan themselves. Crucially, Stoykov advises limiting exposure by capping the guarantee to a set amount, such as 20% of the property's value.

Protect a Financial Gift: If gifting money, they should ensure the property ownership is recorded as 'tenants in common', clearly defining ownership percentages. They can also specify that the gift is solely to their son, not to the couple jointly, protecting his share if the relationship ends.

Formalise a Family Loan: Even for an interest-free loan, a signed agreement between all parties protects everyone's intentions. This is about clarity, not mistrust, and prevents money from muddying relationships if circumstances change.

The Final Verdict: Love with Boundaries

Vanessa Stoykov encourages Joanna and Greg to have their son and his partner speak with a mortgage broker and a lawyer before making any commitment. This small investment could prevent enormous stress later.

She concludes that while helping children onto the property ladder is a wonderful goal, it must be done in a way that preserves the parents' own safety and security. Sometimes, the best help is a 'yes' that comes with clear, protective boundaries.